Börsipäev 19. november

Kommentaari jätmiseks loo konto või logi sisse

-

Pärast globaalset sentimenti paranemist eile on liikumine Aasia turgudel jäänud täna positiivseks, seda eesotsas Hiinaga, kus indeksid sooritasid päeva teises päevas tugeva taastumise ning on jõudnud 0,8% plussi. USA futuurid püsivad eilsete sulgumistasemete lähedal.

Makrokalender jääb täna väga õhukeseks nii Euroopas kui USA-s. Jätkuva tähelepanu all saab olema IMF-i, Euroopa Liidu ja Iirimaa läbirääkimistel. Iiri keskpanga juhi eilsetest kommentaaridest võiks arvata, et kokkulepe on puhtalt aja küsimus ning mõned pakuvad abipaketi väljakuulutamist juba nädalavahetusel.

-

Nii kui jalgealune natuke värisema hakkab, on USA väikeinvestorid pooranud end juba teise usku, mis näitab kui suurt ebakindlust praeguses turuolukorras tuntakse.Eelmise nädala über bullish tasemetelt sooritas sentimendi indeks sel nädalal suurima kukkumise alates 2009.a jaanuarist.

-

Viimasel ajal on Hiina suhtes pessimistlikumaks muutunud mitmed analüüsimajad, sealhulgas Goldman Sachs ja Nomura, kes tuginevad oma arvamuses nägemusele, et inflatsiooni kiirenemine tingib karmima rahapoliitilise keskkonna. Sellele, et ralli Hiina aktsiaturgudel võib läbi olla, viitab ka uute väärtpaberitekontode avamise statistika, mis varem on teinud oma tippe täpselt siis kui turud hakkavad allapoole liikuma. Uued investorid eiravad tihti fundamentaale ning üritavad rongile hüpata, kui näevad, et teised turgudel raha teenivad, ent tihti päädib see paljude jaoks raha kaotamisega. Eelmisel nädalal avasid eraisikud Hiinas ligi 600 000 väärtpaberikontot, mis on 15 kuu kõrgeim tase. Samal ajal aga saavutas Shanghai Composite 7 kuu tipu ning on pärast seda sooritanud ca 10%lise kukkumise.

-

Tänane Reuters kirjutab, et Nokia kauaoodatud N8 nutitelefonil on täheldatud mõningaid tehnilisi probleeme, kuna osadel klientidel lülitab telefon ennast ise välja ning pärast ei õnnestu seadet enam tagasi tööle saada. Ettevõtte esindaja sõnul on viga ka leitud ning parandatud.

Olulise hilinemisega letile jõudnud Nokia uus lootus N8 on oma konkurentide toodetest üle 12-megapikslilise kaameraga, aga jääb alla aeglasema protsessoriga.

-

N97 tegi sama asja. Natuke halb kui ühed ja samad probleemid uuemate mudelite puhul korduvad.

-

Iriimaa, IMF-i ja EL-i läbirääkimiste üheks vaidluspunktiks võib kujuneda ettevõtete soodne maksukeskkond, mis pole ülejäänud Euroopa silmis kuigi aus. Tänane FT kirjutab, et Saksamaa ja Prantsusmaa ähvardavad ilma kokkuleppeta ära jalutada, juhul kui makse ei tõsteta. Ka Olli Rehn on selle poolt. Seda, kas oma ähvarduste juurde ka kindlaks jäädakse on muidugi küsitav, kuna Euroopa riigid ja IMF suruvad ise abi peale eesmärgiga hoida ära süsteemse riski tekkimist.

-

Eile hääletas USA ravimiameti ekspertide komisjon (panel) Mela Sciences (MELA) nahavähi tuvastamise seadme MELAFind poolt ( häältega 8-7). Positiivne otsus tuli vaatamata väga teravale ravimiameti kriitikale.

Adam Feuerstein, kes oli samuti negatiivsel seisukohal, kirjutab täna TheStreet.com veebilehel, et tema jaoks tuli positiivne otsus üllatusena. Ta tunnustab firmat selle eest, et too suutis oma seisukohti piisava veendumusega tõestada ning saavutada seeläbi ka komisjoniliikmete poolehoid, vaatamata sellele jääb Feuerstein ravimiameti heakskiitva otsuse suhtes üsna skeptiliseks, kuna seadme turvalisus ja efektiivsus on endiselt suur küsimärk.

MELA aktsia, mis oli eile kauplemiseks peatatud, on täis lühikeseksmüüjaid ja Feuresteini sõnul avaneb aktsia kindlasti plusspoolel, aga kui palju, sõltub juba investorite usu ulatusest.

-

Hiina keskpank tõstab kohustuslikku reservimäära 50 baaspunkti võrra

-

Morgan Stanely analüütikud on lisanud oma Research Tactical Idea (RTI) nimekirja täna Weatherford International (WFT)-i aktsia.

Analüütikute sõnul liigub aktsia järgmise 60 päeva jooksul üles.Morgan Stanley usub, et ettevõte üllatab oma kvartalitulemustega rohkem, kui näiteks konkurendid, sest konsensuse ootused on üsna tagasihoidlikud. Nüüd kus WFT kaupleb ka SIX-l ( Šveitsi börs), peaks analüütikute arvates suurendama rahvusvaheliste investorite huvi aktsia vastu.

Listing on the SIX should increase WFT's profile with the int'l investment community (including index buying if included in the SMI or SLI), while positive earnings revisions will be more of a surprise than for peers. Street estimates are barely in line with the low end of guidance for 4Q EPS and are below guidance range for 2011.

Kõige tähelepanuväärsem lause Morgan Stanley analüütikute poolt on aga järgmine:

We see 100% upside for WFT over the next 12 months.Analüütikud on veendunud, et nende tees realiseerub vähemalt 80%-lise või isegi suurema tõenäosusega.

We estimate that there is about an 80%+ or "almost certain" probability for the scenario.Lisaks eelnevale on WFT ka LHV Pro idee.

Kauplemise seisukohast üldjuhul RTI-d vajalikku tähelepanu ei leia.

-

Täna kõige huvitavam reitingumuutus tuleb ilmselt Barclays Capitali analüütikutelt.

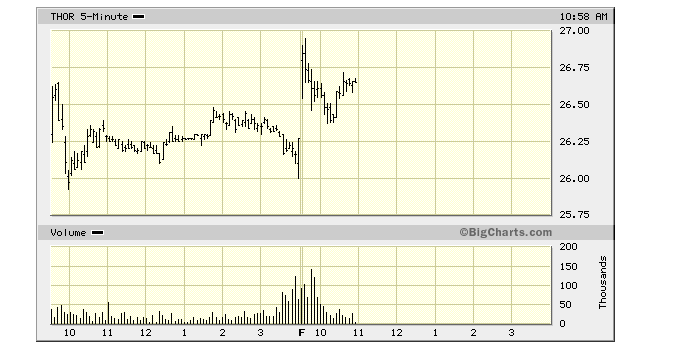

Barclays Capital tõstab Thoratec (THOR) reitingu „hoia“ pealt „osta“ peale koos $39 hinnasihiga.

Mäletatavasti oli alles hiljuti ka foorumis THOR aktuaalne teema. Kes soovib detaile meelde tuletada, leiab teema siit.

Lühidalt öeldes müüdi 15.novembril THOR aktsia üle 20% miinusesse, kuna HTWR esitles THOR-i konkureeriva toote kohta väga positiivseid uuringutulemused. Kuigi tol päeval tulid paljud analüütikud THOR-i kaitsma, ei tahtnud firma suhtes lootuse kaotanud investorid enam aktsiast midagi teada.

Just seetõttu on tänane „osta“ soovitus ka tähelepanuväärne.

This week’s pullback in THOR creates a good entry point because we expect the market to regain confidence in THOR’s market-leading LVAD franchise. The string results from competitor HTWR’s bridge-to-transplant trial, a.k.a. ADVANCE, led many investors to conclude that THOR’s longstanding position of leadership in the LVAD market was in jeopardy if not dislodged. The results from ADVANCE certainly impressed us and confirmed the threat posed by HTWR. However, it’s important to remember that THOR enters the competition as the market incumbent with a loyal surgeon base. The Heartmate II earned its standing as the “gold standard” over many years of both clinical testing and commercial use. Patient outcomes with the pump steadily improve, solidifying its position. HTWR’s HVAD appears up to the challenge, and clinicians welcome an alternative pump, but the Heartmate II won’t be abandoned.

Analüütikud usuvad, et THOR-i aktsia hiljutine langus pakub investoritele soodsat ostukohta. Kuigi analüütikud ise peavad ka HTWR esitlust muljetavaldavaks, siis peaksid turuosalised siiski meeles pidama, et antud turul on nö tootelojaalsus väga määrava tähtsusega ja THOR-i Heartmate II on oma eksistentsi aastate jooksul igas mõttes õigustanud ning võitnud nii kirurgide kui ka patsientide poolehoiu.

We upgrade THOR to 1-OW because we believe its current valuation doesn’t properly reflect the opportunities for either the Heartmate II or the company’s broader LVAD franchise. We have stayed on the sidelines for THOR since launching last year because we never felt expectations were aligned with the LVAD market’s fundamentals. This required patience at times, some might argue stubbornness, but we now see market sentiment becoming excessively negative.

Lühidalt usuvad analüütikud, et turu sentiment on aktsia osas muutunud nüüd juba liigselt negatiivseks ning investorid alahindavad THOR-i võimalusi nii oma kuulsa toote Heartmate II kui ka firma potentsiaali LVAD (left ventricular assist device ) laiemas mõttes.

Usun, et THOR võiks küll täna ostuhuvi leida järgnevatel põhjustel:

• Negatiivne sentiment

• Omajagu sorte sees ( 16%)

• Aktsia väga alla müüdud.Kauplemise seisukohast oleks oluline,et aktsia eelturul liigselt üles ei ostetaks.

-

Gapping up

In reaction to strong earnings/guidance: CRM +9.9%, HIBB +9.7% (ticking higher), FL +9.2%, CEDU +8.0%, WTSLA +5.2%, SCVL +4.4% (light volume), YGE +4.4%, DELL +3.6%, MENT +3.0%.

M&A news: DLM 8.0% (continuing to climb after spiking in afternoon trade following takeover rumor).

Other news: MELA +108.39% (FDA advisory panel votes positively for MelaFind on safety, efficacy and risk/benefit ratio), GST +14.2% (still checking), NYNY +6.5% (announces receipt of $35 mln loan company repays all obligations under its outstanding convertible senior notes ), ARMH +2.2% (still checking), ASML +2.2% (traded higher overseas), AMGN +1.6% (receives FDA approval for XGEVA for the prevention of skeletal-related events in patients with bone metastases from solid tumors ), LVS +1.5% (Moody's upgraded Las Vegas Sands CFR to B1; positive rating outlook ), CSCO +1.1% (authorizes up to $10 bln in additional stock repurchases).

Analyst comments: PT +2.3% (initiated with a Hold at Societe Generale), DD +1.4% (upgraded to Buy from Neutral at Goldman).

-

Gapping down

In reaction to disappointing earnings/guidance: KIRK -8.2% (light volume), ADSK -4.4%, INTU -4.0%, GPS -2.8%.

Select financial related names showing weakness: IRE -5.9%, BBVA -3.3%, IBN -2.3%, RF -1.9%, HBC -1.9%, LYG -1.8%, UBS -1.7%, BCS -1.5%, STD -1.4%, DB -1.2%.

Select metals/mining stocks trading lower: BBL -2.3%, PKX -2.0%, GOLD -1.5%, BHP -1.4%, SLW -1.2%, SLW -1.2%, RIO -1.0%, .

Other news: VALV -14.3% (prices 2,456,800 shares of common stock at $5.50 per share), SOMX -11.0% (Announces Proposed Public Offering of Common Stock), FEN -3.8% (commenced a public offering of 1.5 mln common shares of beneficial interest), KEY -3.2% (announces CEO succession plan: Chairman and CEO Henry L. Meyer III to retire May 1, 2011, and will be succeeded by Beth E. Mooney, currently Vice Chair of co), KITD -3.1% (prices offering of 8 mln shares of common stock at 12.00 per share), ASTM -2.4% (continued weakness following drop on drug data), CVI -2.1% (prices upsized secondary public offering of 18 mln shares of common stock at $10.75), NOK -1.8% (Siemens AG CFO related to potential IPO of the cos jv Nokia Siemens ), PFE -1.5% and BMY -1.2% (APPRAISE-2 study with investigational compound apixaban in acute coronary syndrome discontinued), OMPI -0.9% (announces pricing of secondary offering by, and repurchase of shares from, selling stockholders).

Analyst comments: RES -3.8% (initiated with Sell at Goldman), SPWRA -3.4% (downgraded to Underperform at Wedbush; tgt lowered to $7), NGG -2.7% (downgraded to Neutral from Buy at Nomura ), VRGY -2.4% (downgraded to Hold from Buy at Citigroup; confirmed to report earnings next week on Nov 23 after the close), WFMI -1.2% (downgraded to Neutral from Buy at UBS), TSL -0.7% (initiated with a Negative at Susquehanna), THS -0.5% (downgraded to Hold at Stifel Nicolaus).

-

Rev Shark: Good Technical Setups Are Scarce

11/19/2010 9:07 AMAll you need in this life is ignorance and confidence; then success is sure.

-- Mark TwainAfter an anemic oversold bounce attempt on Wednesday, the bulls regrouped and put together a classic bounce on Thursday. The General Motors (GM - commentary - Trade Now) IPO received much of the credit for the strength but it actually traded quite poorly in view of the endless hype in the media. The stock opened well and almost managed to nudge $36 in early trading, but then it sold off the rest of the day and closed near its lows, ending with a gain of about $1.

The fact that the market was able to digest such a huge IPO is a positive but let's not forget that a ton of liquidity was sopped up to support this behemoth and that is a negative for other stocks. GM is acting poorly in premarket trading and that is going to be a negative if it doesn't find some support before it hits the $33 offering level.

The real driving force behind the strength yesterday was hope that Ireland was close to some sort of bailout from European Union and optimism that the attempts in China to cool off their hot economy would not be as onerous as many anticipate. In fact, China raised its reserve requirements again last night and stocks rebounded after a brief stumble as the news hit.

Federal Reserve Chairman Ben Bernanke is overseas today, arguing that the weakness in the dollar caused by QE 2 really isn't such a bad thing and that emerging economies need to let their currencies rise against the dollar. The market isn't particularly thrilled about the worldwide unhappiness with QE 2 and that is causing some pressure in the early going.

Yesterday, I was pondering whether this market had the capacity to pull off another V-shaped bounce and fight back to recent highs. Being confident and ignoring the basic rule that V-ish bounces shouldn't be trusted very much has been the way to make money in this market. Technically, V-shaped bounces are always suspect but that rule has been a loser for the last 18 months.

Normally after a sharp pullback, trapped bulls look to escape and aggressive shorts look to reload into strength. That has not been the norm in this market for some reason; I tend to attribute it to the flood of liquidity caused by the Fed. That cash needs to go somewhere and anytime the market is off its highs, it tends to flow there. Market players are constantly worried that they will be left out as the market bounces back after a pullback.

This tendency toward V-ish bounces creates a dilemma for disciplined traders. On one hand, we don't want to chase bad entries, but on the other hand, this market has consistently rewarded exactly that behavior. From my standpoint, it still isn't worth the risk but I've learned to respect this resiliency and am not going to fight it.

What makes things particularly interesting at this juncture is that we are heading into some of the most positive seasonality of the year. Trading around Thanksgiving and into the end of the year is usually quite upbeat so we'll have to watch how sentiment develops.

Yesterday's bounce is under attack this morning. We'll have see if the bulls are going to make a stand and actually allow the market to roll over which has been the more typical technical action after a dip such as the one the market suffered recently.

I plan to keep looking for good technical setups to buy, but I don't expect to find much. In fact, I hope I don't find much because a day or two of rest now would be a good setup for some good Thanksgiving trading. If we stay flexible and keep to a short-term strategy, we should be in good shape.

Long GM

-

Marc Faber jagamas kommentaare pärast reservmäära tõstmist Hiinas...link Bloombergi videole

-

THOR täna oodatud ostuhuvi ei tekitanud. Oma osa oli siin kindlasti mängida ka turul, mis kohe avanemisel võimalikud ostjad THOR-st välja loputasid. Hetkel on turg kosunud ja ka THOR kõrgemale liikunud, kaubeldes 2,3% plussis. Igal juhul ei leevendanud Barclays ostusoovitus turuosaliste negatiivset suhtumist aktsiasse ning sellises suurusjärgus liikumist nagu ma oleks oodanud ikkagi ei toimunud.

-

Loral Space & Communications (LORL) Intelsat has reportedly hired advisors to pursue a buyout of Telesat

- Note: Loral supplies satellites for Intelsat and has a financial interest in the company

Pea +23% uudise peale, hetkel kauplemas $83.43 -

Lisaks: LORL owns more than 60% of Telestat.

Tehingu väärtus esialgsetel andmetel peaks olema ~7 miljardit -

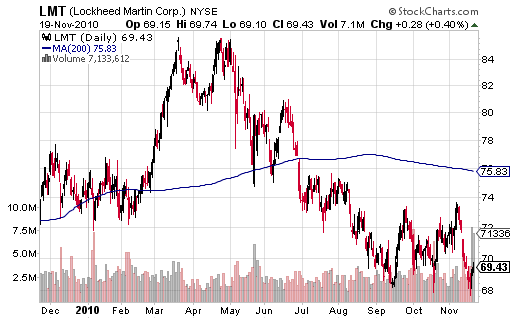

Lockheed Martin Corp. sõlmis täna hetk enne turgude sulgemist USA kaitseministeeriumuga neljanda hävitajate F-35 tootmislepingu, mille kohaselt toodab aasta kolmandas kvartalis $11.4 miljardit tulusid näidanud LMT 31 hävitajat, mille hinnaks on kokku ca $3.48 miljardit. Uudisele on seni reageerinud 3 analüüsimaja – RBC Capital on väljas $71lise hinnasihiga, SunTrust $80lise hinnasihiga ning Jefferies $82lise hinnasihiga. LMT aktsia on käesoleval aastal odavnenud ca 10%.