Börsipäev 30. november

Kommentaari jätmiseks loo konto või logi sisse

-

Turgude jaoks pole Iirimaa laenupaketi täpsemate detailide avalikustamine erilist muljet avaldanud ning vastupidiselt oodatule, liikusid mitmete riikide CDS-id ja võlakirjade intressid eile hoopis kõrgemale. Aasias on sentiment jäänud hommikul negatiivseks, kuid Euroopa on tegemas teist katset ülespoole liikuda pärast eilset tugevat langust. USA indeksite futuurid liiguvad hetkel veel kerges miinuses.

Kuigi esiplaanile jäävad endiselt arengud Euroopa riikide võlakirjaturgudel, siis tänasesse päeva mahub ka palju olulist makrot. Saksamaal avaldatakse kell 10.55 novembrikuu töötusemäär, mille osas ootab konsensus jätkuvat alanemist. Kell 12.00 avaldatakse eurotsooni oktoobrikuu töötusemäär, mis peaks jääma muutumatuks 10.1% peale. Enne neljapäevast EKP kohtumist saab olema huvitav jälgida ka arenguid eurotsooni inflatsiooni osas. Keskpäeval avaldatav novembrikuu tarbijahinnaindeksi esmane näit peaks jääma 1,9% juurde ehk väga napilt alla Euroopa keskpanga keskpika sihi. USA sessiooni ajal tuleb aga kell 16.00 Case-Schilleri indeksi septembrikuu muutus, kell 16.45 Chicago PMI ja 15 minutit hiljem novembrikuu tarbijausalduse indeks.

-

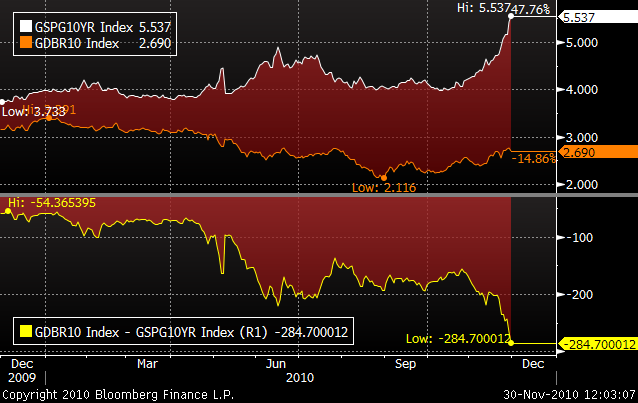

Itaalia ja Saksamaa 10-aastaste võlakirjade tulususte erinevus laienenud 200 baaspunktini.

-

Saksamaa töötusmäär vastavalt ootustele 7,5%. Töötute arv vähenes oodatud 20K asemel 9K.

Euro müügisurve jätkub: EUR/USD -0,63% ja kaupleb $1,3040 juures. -

Tänane Wall Street Journal kirjutab, et eile teatas Seagate Technology (STX), et lõpetas läbirääkimised private-equity firmadega, kuna pakkumised ei osutunud siiski piisavalt atraktiivseks.

Turuosalistele selline asjade kulg ilmselgelt meeltmööda polnud ning eilsel järelturul kukkus aktsia $13 kanti, aktsia eilne sulgumishind oli $13,86. Olgu öeldud, et $19 oli see hind, mida firma lootis aktsia eest saada.

-

EURUSD langenud 0,9% ja testib 1,3000 taset.

-

Eurotsooni töötusmäär vastas ootustele 10,1% juures. Tarbijahinnaindeks vastas samuti ootustele 1,9% (Y/Y) juures.

EURUSD läbis 1,3000 piiri ja hetkel on põhjaks 1,2981. -

Euroopa valuläve testitakse edasi...Hispaania ja Saksamaa 10a võlakirjade spread jõudis uute rekorditeni. Niisamuti teeb uusi tippe Itaalia ja Saksamaa võlakirjade tulususte erinevus. Samal ajal kui ECB ise on võtnud suuna vähendada turul erakorralisi likviidsusmeetmeid, võiks see olla kahtlemata üheks tuliseks teemaks neljapäevasel pressikonverentsil.

Alloleval graafikul on kujutatud Hispaania ja Saksamaa 10 võlakirja yieldi.

-

Teatavasti istub rasvumisvastaste ravimiarendajate seltskonnast järgmisena kuumale toolile Orexigen Therapeutics (OREX). Järgmisel nädala, 7. detsembril koguneb USA ravimiameti ekspertide komisjon (panel) taas kokku arutamaks, kas OREX-i kaalualandav ravim Contrave on piisavalt efektiivne ja ohutu.

Contrave on kombinatsioon naltreksoonist, mida kasutatakse alko-ja narkosõltuvusest vabanemiseks ning bupropioonist (antidpersessant).

Reutersi artiklist saab lugeda, et rasvumise vastu on üritatud võidelda juba mõnda aega ning esimesed katsetused ulatuvad tagasi 19.sajandisse. Mitte väga ammu, 1940ndatel oli kaalualandava ravimina kasutusel amfetamiin.

-

DailyFX andmete kohaselt on võimalik, et praeguse euro müügisurve taga on Prantsusmaa reitingu alandamine, probleemid Saksamaa pankade likviidsusega ja Euroopa keskpanga hädaolukorra laenudega, kuid need on kinnitamata kuulujuttude tasemel.

-

Mõned huvitavad mõtted Goldman Sachsi varahalduse juhilt Jim O'Neill'lt

While everyone remains fixated with the level of debt and deficits, in my judgment the key issues are the governance of EMU and the leadership of it. If Germany and, to a lesser degree France, want to support all the current members and demonstrate their clear belief of this, then the debt and deficits can be resolved. While the numbers for Greece, Ireland and Portugal are all very large with respect to their own GDP, compared to the amount of investable savings out there, the debt and deficit numbers are really not all that large. For example, while Greece has debt-to-GDP of 115 pct, Greece represents less than 3 pct of the Euro area. One of the themes of the week has been “if it gets to Spain, then the EMU is finished because their debt is just too much for Europe to handle.” Spain’s debt- to- GDP is about 53 pct according to Goldman Sachs Global Investment Research, but this is only about 5.3 pct of the Euro area’s GDP. By comparison, the US debt level is around 80 pct of US GDP. And, it is similar for the Euro area as a whole. Just as the US has no problem supporting its debt – at least for now, then at some stage, if all Europe’s leaders put their minds to it, neither will they. The next few weeks, and perhaps beyond, will be all about how Germany is going to continue to support EMU and at what price. The question of whether or not German will support the EMU is not really the main question, it is at what price.

-

Prantsusmaa eelarveminister Francois Baroin sõnul Prantsusmaad reitingu alandamine ei ähvarda.

-

Täna on üsna põneva reitingumuutusega väljas Jefferies&Company analüüsimaja.

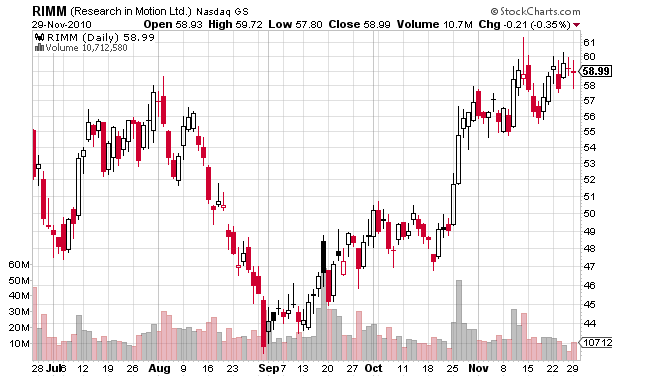

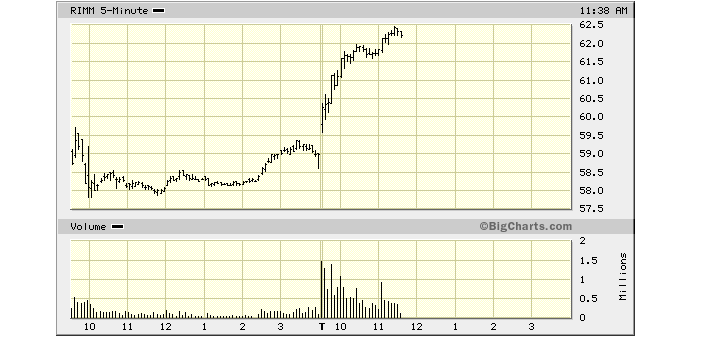

Jefferies analüütikud tõstavad Research in Motion (RIMM)-i reitingu „hoia“ pealt „osta“ peale ja hinnasihi $55 pealt $80 peale.

Key Points

1. QNX better and earlier than expected: our checks indicate that the new OS provides a great browsing experience, is scalable so can address low end and high end, is easy to port Android apps to, and is more secure, and requires less bandwidth. Also, the transition to QNX will be faster than expected.

2. International growth should carry RIMM until the new QNX products launch. The strength comes from Blackberry Messenger (BBM) as a free texting service and from the launch of a consumer service in China.

3. Enterprise share loss slower than feared: our checks indicate enterprise app stickiness (email-only enterprise users more at risk from share loss due to sandboxing) and non-enterprise app data charges are likely to lead RIMM to only lose 300K enterprise subscribers in CY11.Eelkõige juhivad analüütikud tähelepanu sellele, et RIMM-i QNX on kohal varem ja parem kui oodatud. Analüütikute sõnul on uus OS turvalisem, nõuab väiksemat ribalaiust ja Androidi aplikatsioone on väga kerge teisaldada. Teiseks peaks rahvusvaheline kasv toetama RIM-i seni, kuni QNX turule jõuab. Rahvusvahelise kasvu all peetakse silmas eelkõige BBM-i , sest vaatamata selle, et RIM on olnud Hiina turul juba alates 2006. aastast, siis BBM teenus sai Hiina tarbijatele kättesaadavaks alles eelmisel nädalal. Kolmandaks on analüütikuste sõnul turuosa kaotus korporatiivklientide hulgas väiksem, kui kardetud.

Usun, et Jefferies`i positiivne reitingumuutus paneb täna RIMM-i aktsia liikuma, sest sentiment on firma suhtes olnud ikkagi üsna negatiivne. RIMM aktsia on viimasel ajal teinud küll läbi korraliku ralli, sest nii mitmedki analüüsimajad on oma nägemust RIMM-i tuleviku suhtes muutmas. Samas on aktsiat endiselt kammitsemas turuosa kaotus korporatiivklientide seas ja Jefferies analüütikute arvamus peaks selles osas tooma leevendust.

Turg ei näe hetkel väga hea välja,aga RIMM-i $61 tase ei tohiks ületamatu olla.

Hetkel kaupleb RIMM ca 2% oma eilsest sulgumishinnast kõrgemal, $60,20 kandis.

-

Üpris huvitava reitingumuutusega on täna väljas ka PiperJaffray.

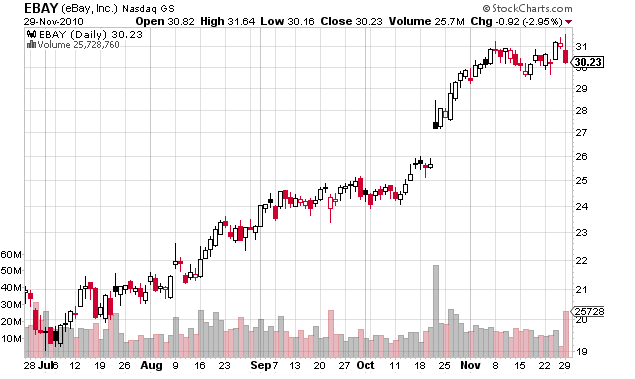

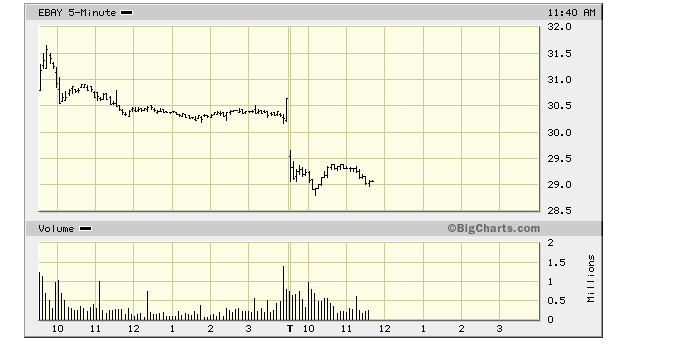

PiperJaffray analüütikud alandavad eBay (EBAY)-i reitingut „osta“ pealt „hoia“ peale koos $30 hinnasihiga.

eBay Getting More Innovative, But Still Losing Share. eBay is making strides becoming more innovative, mobile being a great example. While we are positive on eBay's leadership in mobile and think PayPal is a great business, we don't believe the pace of innovation from marketplace is fast enough to stall market share losses any time in the next 2 years, which could hamper earnings growth for the overall company despite 30% annual profit growth from Payments.

What should eBay do? Continue to improve the search experience and produkt standardization on marketplace, as we have seen eBay recently do in some categories such as iPods, GPS devices, and DVDs. We think these are great improvements and the company will continue to do more, but will take time given the breadth and depth or products available on the site. Bottom line, we'd like to see faster innovation from eBay marketplaces.

Lühidalt kokku võttes usuvad analüütikud, et vaatamata firma püüdlustele olla innovaatilisem, enne kahte aastat ei suuda firma kaotatud turuosa tagasi võita. Analüütikud ei heida ettevõttele oluliselt midagi ette, aga näeksid siiski parema meelega, et EBAY oleks muutuste elluviimisel kiirem.

Aktsia sai ka eile Stifel Nicolaus`lt „hoia“ reitingu, aga oluliseks liigutajaks oli eile ilmselt turg. Ka täna tundub turg soosivat pigem lühikesi ideid. Täna oleks üsna tõenäoline, et turuosalised võtavad arvesse analüütikute väidet turuosa tagasi võitmise osas ning otsustatakse aktsias kasumit võtta.

-

Gapping up

In reaction to strong earnings/guidance: SODA +4.8%.

M&A news: BEZ +40.2% (to be acquired by ABB for $63.50 per share in cash), ARG +1.0% (Air Products extends by 10 business days its tender offer to acquire Airgas for $65.50 per share in cash).

Other news: KERX +9.7% (announces highly statistically significant positive results from phase 3 study of Zerenex for the treatment of hyperphosphatemia in dialysis patients ), BWEN +8.2% (Vestas selects BWEN Towers for Glacier Hills WInd Project; Backlog stands at $245 mln, up 17% since September 30), CLDA +8.1% (to Sell FAMILION testing and pharmacogenomics biomarker development business for $15.4 mln plus potential milestones, royalties and other consideration), FRPT +4.8% (signed a contract with the UK Ministry of Defence to supply an order of 200 Ocelots and an initial spares package for the Light Protected Patrol Vehicle valued at ~$280 mln), IBKR +4.2% (declared a special cash dividend of $1.79 per share on the Co's outstanding shares of common stock), DECK +3.0% (Cramer made positive comments on MadMoney), AMRN +2.6% (continued strength), OXPS +2.0% (continued stregnth; also getting boost from IBKR news), SYMC +1.9% (ticking higher; strength attributed to speculation co is seeking strategic alternatives), SGMS +1.2% (announced the Co's Chairman will also become Chief Executive Officer ), NANO +1.0% (light volume, announces $10 million share repurchase program).

Analyst comments: SOMX +7.4% (initiated with an Overweight at Piper Jaffray), RIMM +1.9% (upgraded to Buy from Hold at Jefferies).

-

Täna hommikul tegin juttu OREX-st ja selle kaalualandavast ravimist Contravest.

Siin on TheStreet link, kus Adam Feuerstein annab põhjaliku eelvaate järgmisel nädalal toimuvale panel`le.

-

Gapping down

In reaction to disappointing earnings/guidance: ZOLT -13.0%, ROSG -9.7% (also announces $2.5 million private placement; under the terms of the offering, Rosetta will sell an aggregate of 2,500,000 ordinary shares at a price of $1.00 per share), CBAK -4.2% (also appoints Marcus Cui as interim CFO; Jun Zou notified co of intention to retire on 9/30/2010), SDRL -4.1%, MCOX -2.8%, MCHP -2.0%.

M&A news: STX -4.3% (terminates private equity discussions and announces $2 bln share repurchase; Sees Q4 revenue of $2.7 bln, consensus $2.698 bln), ABB -0.5% (to acquire BEZ for $63.50 per share in cash).

Select financial related names showing weakness: ING -7.6%, BBVA -5.3%, BCS -3.8%, DB -3.7%, STD -3.5%, AEG -2.8%, UBS -2.8%, CS -2.5%, RBS -2.4%, LYG -2.4%, FITB -1.6%, HBAN -1.6%, HBC -1.5%, WFC -1.3%, AIG -1.2%, PRU -1.1%, BAC -0.9%.

Select metals/mining stocks trading lower: MT -2.0%, BHP -1.4%, AU -1.3%, RIO -1.3%, CLF -1.3%, X -1.2%, AA -1.3%.

Select oil/gas related names showing weakness: RDS.A -2.4%, TOT -2.4%, SSL -2.3%, BP -2.2%, SNP -2.1%, E -1.8%, NOV -1.7%, ACGY -1.7%, SU -1.6%, REP -1.5%, HAL -1.3%, PBR -0.9%.

Select large cap drug names under pressure: SNY -3.2%, GSK -2.3% AZN -2.2%, NVS -2.2%.

Other news: VSI -4.6% (filed for a ~6.30 mln share common stock offering by selling shareholders), TICC -4.2% (announced that it has commenced a public offering of 4 mln shares of its common stock), CMED -3.6% (announces proposed private offering of $100 mln convertible senior notes), COMV -2.6% (discloses contract amendment with Consolidated Edison), WDC -1.1% (STX peer).

Analyst comments: CHK -1.8% (downgraded to Sell from Hold at Argus), EBAY -1.2% (downgraded to Neutral from Overweight at Piper Jaffray).

-

Gearing Up for Another Ricochet

11/30/2010 8:51 AMWhat's the point of going out? We're just going to wind up back here anyway.

-- Homer Simpson

For the fifth day in a row, the market is looking to gap open in the opposite direction of yesterday's close. It's very tough to have confidence in positions when there is no follow-through, but that is the nature of a trading range, and a trading range is exactly what we are seeing right now.

For the 10th day now, the S&P 500 is trading between 1200 and 1173. On Monday the index tested the lower end of the range, which is also the 50-day simple moving average, but it held exactly where it needed to do so and bounced strongly to finish the day. Of course, when there is a trading range, the index tends to gap down the next morning following a strong finish.

The fears causing the selling this morning are nothing new. The European sovereign debt issue just isn't going away. There are worries that bailing out Ireland will not prevent the string of dominos from falling. The big concern is Spain, which has a much larger economy than the other countries that have needed help.

In addition to the ongoing European issues, there are concerns that China will continue to take actions to cool off its economy in order to keep inflation in check. That weighed on Asian markets last night.

The good news is that the market has cleared defined negatives, and we know that the S&P has key support right around 1175. It is helpful to know the bear argument against the market and what levels must hold in order to keep the bears in check. We know that if the S&P doesn't hold 1175 and the 50-day simple moving average, then the market is worried and we haven't sufficiently discounted the overseas woes.

What has really been helping this market lately is that economic news has not produced any real negative surprises, and we are seeing some pretty decently acting stocks -- especially some of the bigger cap technology names, such as Amazon (AMZN - commentary - Trade Now) and Netflix (NFLX - commentary - Trade Now). Many stocks have strong fundamentals, and market players just aren't allowing them to slip very much. The dip buyers are eying some names and have had sufficient confidence to jump in on weakness. That is keeping some support under the market for now.

The best way to play a trading range market is to trade it. As always, that means short time frames and an agnostic viewpoint. This is not the environment in which you want to build positions in hopes of catching a trend. Sooner or later the market will break out of the trading range and a trend will develop -- but, right now, stocks are just battling back and forth, and if you don't stay flexible you are going to be jerked around.

Early indications are that the market will gap down, but consumer confidence and the Chicago Purchasing Managers Index are scheduled for release shortly after the open, which will likely have an impact on the mood. If we stay open minded and flexible, this trading-range market can actually be quite profitable.

-

USA indeksite futuurid indikeerimas avanemist 0,8% kuni 1,1% miinuspoolel

Euroopa turud:

Saksamaa DAX -0,37%

Prantsusmaa CAC 40 -1,00%

Suurbritannia FTSE100 -0,43%

Hispaania IBEX 35 -1,05%

Rootsi OMX 30 -0,53%

Venemaa MICEX +0,15%

Poola WIG +0,52%Aasia turud:

Jaapani Nikkei 225 -1,87%

Hong Kongi Hang Seng -0,68%

Hiina Shanghai A (kodumaine) -1,62%

Hiina Shanghai B (välismaine) -0,86%

Lõuna-Korea Kosdaq +0,82%

Austraalia S&P/ASX 200 -0,74%

Tai Set 50 -0,60%

India Sensex 30 +0,60% -

September Case-Shiller 20-city Index +0.59% vs +1.00% Briefing.com consensus, prior revised to +1.67% from +1.70%

-

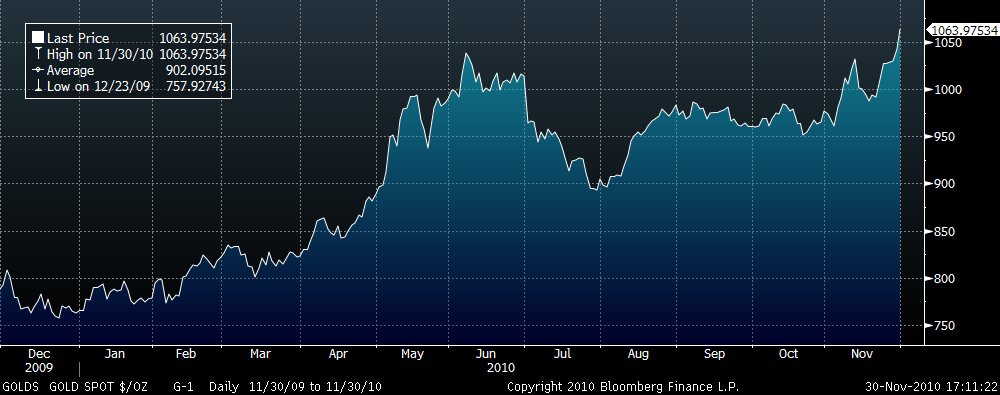

Kulla futuur on täna tõusnud 1,22% ja kaupleb hetkel $1384 juures.

-

November Chicago PMI 62.5 vs 59.6 Briefing.com consensus; October 60.6

-

Reuters kirjutab täna, et kaks USA senaatorit kutsuvad üles hääletama seaduse poolt, mis võimaldaks valitsusel karmistada oma käitumist Hiina suunas (tingituna hiinlaste valuutamanipulatsioonidest). Tegemist on seadusega, mis läbis USA kongressi alamkoja käesoleva aasta septembris ja mida ("üllatuslikult") toetavad erinevad töötajate ametiühingud, terasekompaniid ja muud tootjad, kes ei suuda Hiinaga konkureerida.

Seadus näeb ette, et USA kaubandusministeerium saaks valuuta manipuleerimist võtta kui subsiidiumi ja seeläbi kehtestada imporditavatele kaupadele (mille suhtes ametivõimud võivad kahtlustada "ebaõiglast" hinda) suuremad tariifid, mille tulemusena muutuksid kaubad USA tarbija jaoks kallimaks.

Õnneks on kellelgi ka mõistust peas: 40 ettevõttest ja farmide gruppidest koosnev koalitsioon, mille hulka kuulub teiste seas ka USA-Hiina kaubandusnõukogu ja USA kaubanduskoda, hoiatasid, et selline samm annaks korraliku vastulöögi USA ekspordile Hiina. Siin saab näha vana võistlust: special interest vs market.

-

November Consumer Confidence 54.1 vs 52.0 Briefing.com consensus; October 50.2

-

Kuld tegi täna uue kõikide aegade tipu mõõdetuna euros:

-

The Fed purchased $6.81 bln of 2014-2016 maturities through Permanent Open Market Operations as dealers looked to put back $23.5 bln

-

Euroopa keskpanga juht Jean-Claude Trichet pidas äsja Brüsselis kõne, kus märkis, et inflatsiooniootused jäävad "aheldatuks" ja inflatsioonimäär jääb püsima 1,9% kanti. Ta lisas, et viimased makroandmed kinnitavad majanduse taastumise positiivset momentumit. Iirimaa abipaketi kohta ütles Trichet nii palju, et see on tervitatav ja ELi seisukohast on majandusliidu ühtne toimimine kriitilise tähtsusega.

-

Tänane RIMM-i call osutus lausa üle ootuste heaks. Eelturul kauples aktsia $60 kandis ning hetkeks tundus, et müügisurve all olev turg võtab ära ka RIMM-i call`i jõu. Peale avanemist aga sai aktsia ostujõu taha ning kaupleb hetkel $5,6% plusspoolel, $62,30 kandis. Olenevalt sellest, kui palju kellelgi kannatust jätkus, oli ka kasumi suurusjärk, aga ilma ei oleks tohtinud küll keegi jääda.

EBAY seevastu osutus natuke keerulisemaks mänguks täna. Avanemisel kauples aktsia pikka aega vahemikus $29,10-$29,40 ja ei tahtnud kindlat suunda võtta. Nagu graafikult näha käis aktsia lõpuks siiski $28,80 tasemel ka ära. Kes jõudis selle ära oodata, sai ilmselt ca $0,30-$0,40 kasumit, aga kes ei jõudnud, siis ei saa neid ka kannatamatuses süüdistada, sest call`i tugevus ei andnud alust väga pikalt positsioonis oodata.

-

President Obama says they should work to make sure taxes don't go up by thousands of dollars on hard-working middle class Americans come Jan. 1; says there was broad agreement on this resolution

-

President Obama says he asked Congress to extend unemployment benefits (which expire today) to people facing tough times

-

Trina Solar (TSL): Wedbush raises FY10 EPS est above consensus to reflect Q3 beat and higher shipment guidance

Wedbush notes that TSL beat their Q3 ests and raised 2010 shipment guidance. Cost reductions and capacity expansions continue. Firm is increasing their 2010 GAAP EPS est to $3.28 from $2.85 (cons: $2.99) to reflect the Q3 beat and higher shipment guidance for 2010. They are positive on TSL relative to its peers given the co's low cost structure and competitive position.

TSL võiks siit tuge saada, kuid tururisk jääb. -

TSL puhul jäi Jefferies oma osta reitingule kindlaks ja target $40, kuid täna solarid ikka väga rasked.

-

LDK Solar (LDK)convertible exchange if successful would be a modest positive - Barclays

Barclays notes last week, LDK announced its plans to offer up to $300 million of its currently outstanding 4.75% convertible senior notes due in 2013. They believe this exchange, if successful, would be a modest positive for the shares. LDK currently has $395 million of the 2013 bond outstanding, which would be eligible for early repurchase in April 2011. Under the announced plans, LDK will only need to pay between $18 million and $25 million now, and would have only $95 million in debt eligible for repurchase in April 2011. Firm believes potential Q4 EPS upside to ~$0.90 exists if LDK is successful in exchanging the converts and does not need to raise money.

Barclays kergelt positiivsust süstimas, kuid aktsia täna tugeva müügisurve all. -

Deficit Commission delays vote on Deficit Reduction Plan by two days, until Friday

-

S&P places Portugal 'A-/A-2' ratings on watch negative on uncertainty regarding the effects of the proposed EU treaty change