Börsipäev 9. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia indeksid on suures osas alustanud päeva positiivse noodiga tänu Jaapani kolmanda kvartali majanduskasvule, mis annualiseeritud kujul oli 4,5% ehk 0,9 protsendipunkti võrra parem võrreldes valitsuse esialgse hinnanguga. Austraalia üllatas aga oodatust parema tööjõuraportiga. Viimase kohaselt tõusis tööhõive oktoobris 54 600 inimese võrra, rohkem kui Bloombergi prognoositud 20 000. Laupäevane inflatsiooniraport ja võimalik intressimäära tõstmine vedasid aga Hiina indeksid üle protsendi miinusesse.

Euroopa sessiooni ajal avalikustab Inglise keskpank oma intressimäära otsuse ning võimaliku muutuse QE programmis, ent analüütikud valitsuse võlakirjade täiendavat ostmist väga tõenäoliseks ei pea, kuna viimase aja makro on üllatanud pigem positiivselt. Turusentimenti olulisemaks kujundajaks võiks osutuda möödunud nädala esmase töötuabiraha taotluste arv USA-s (kell 15.30), mis konsensuse arvates vähenes 436K pealt 429K peale. Kestvate taotluste arvuks oodatakse 4240K vs 4270 eelneval nädalal.

Euroopa indeksite futuurid indikeerivad avanemist 0,8% kõrgemal, USA futuurid kauplevad hetkel 0,4-0,5% plusspoolel.

-

Hommikul avaldati Saksamaa novembrikuu tarbijahinnaindeksid, mis tulid kõik vastavalt ootustele: 0,1% (M/M) ja 1,5% (Y/Y). Euro on Aasia sessioonil saavutatud edu ära andmas ja on päevasest tipust $1,3322 tasemelt kukkunud $1,3280 peale.

-

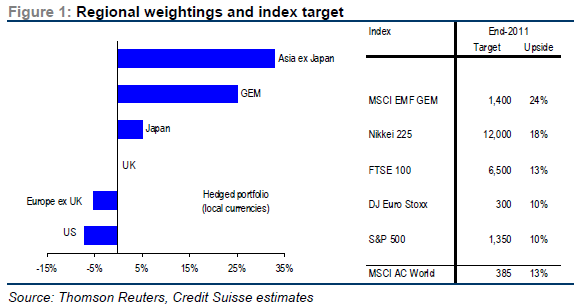

Credit Suisse, kes on vaatamata võlakriisile Euroopas ja hirmule, et USA majanduskasv aeglustub oodatust kiireimini, jäänud viimase poole aasta jooksul raudkindlaks oma bullish nägemusele ning ootab aktsiaturgude outperformimist ka järgmisel aastal. Toon siia kokkuvõtte peamistest põhjustest:

Equities: stay overweight (as we were through 2010). We forecast a 13% return over the course of 2011. The following factors keep us overweight:

■ Economic momentum has stabilised and earnings revisions are still positive;

■ Equities offer better value than all other major assets classes. The equity risk premium is 7.3% on IBES numbers (and 6% on our preferred measure, which assumes IBES growth figures for two years, then reverts growth back to trend). This compares to a long run average ERP of 3.6% and our target ERP of 4.3% (based on credit spreads and ISM index).

■ Equities are among the cheapest inflation hedges at a time when the Fed is aiming to push up inflation. Equities only de-rate once inflation expectations rise above 4%;

■ We forecast 11% EPS growth in the US (our US strategist Doug Cliggott is more cautious at 4%) and 15% in Europe. Although margins are very high, our models suggest that margins do not fall until labour gets pricing power;

■ Both asset turns and leverage are abnormally low. If leverage were to return to 2x net debt to EBITDA, we calculate US EPS would rise by 12%;

■ Last time credit spreads were here (December 2007), the S&P500 was at around 1,500;

■ Long term investors (retail, pension funds and insurance companies) are fundamentally cautiously positioned in equities. Yet, very recently investors have started to switch out of bond funds and into equity funds. We believe that cash financed buyback activity and M&A will pick up;

■ The third year of the US Presidential cycle has been an up year on each occasion since 1952 with an average return of 18%:

■ Some tactical indicators are slightly extended near-term (equity sentiment is a 4-year high) but critically neither the risk appetite nor the equity sector risk appetite are extended relative to their norm.Allokatsioon on tugevalt kallutatud arenevate turgude kasuks. Jaapan on taktikaliselt kergelt overweight peale tõstetud, Euroopa ja USA aga underweight. Euroopa osas tuuakse välja erandina Saksamaa, Norra, Šveits ja Rootsi, kus makronäitajad on tugevamad (Saksamaa ja Rootsi puhul lisaks alahinnatud valuuta), mistõttu soovitatakse nende majanduste kohalikke play'sid.

-

Detsembri 8. ja 9. kuupäeval on Pariisis toimumas LeWeb internetiteemailine konverents, kuhu tulevad kokku ettevõtjad, investorid ning ajakirjanikud, arutamaks uusi võimalusi, mida netikeskkond meile pakkuda võiks.

Tänanes Wall Street Journal`s kirjutab Neil Mcintosh kohtumisest Nokia asepresidendi Marko Ahtisaariga, kes LeWeb-il rääkis nutitelefonide arengust ning Nokia rollist seal.

Ahtisaari jutust võib igal juhul järelda, et Nokia on uude aastasse astumas vägagi revolutsiooniliste meeleoludega. Nimelt ütles Ahtisaari, et koos oma uue MeeGo OS-i turule toomisega ( 2011) kavatseb Nokia telefonile luua täiesti erilise ja omanäolise kasutajaliidese. Ilmselgelt ei soovinud ta kuulajaid detailidesse liigselt küll pühendada, kuid lisas siiski, et praegused puutetundlikud nutitelefonid nõuavad kasutajatelt liigset süvenemist ning inimesed on sunnitud käima pea maas, sest telefoni käsitlemine võtab neilt kogu tähelepanu. Nokia tahab inimestele tagasi tuua nii öelda võimaluse käia pea püsti, viidates sellele, et füüsilisi nupukesi MeeGo seadmetel leidub vähe.

-

Euro viimase tunni jooksul sattunud tugeva surve all: EURUSD -0,37% ja kaupleb 1,3212 juures.

-

Bloombergi eilses inftervjuus on BofAML VC Tom Petrie avaldamas arvamust, mis suunas võiks nafta järgmisel aastal liikuda. QE2, võimaliku maksuseaduse läbisurumine USA-s ning arenevate turgude agressiivne kasv on tema meelest eelduseks, et 100 dollari hind pole taas enam kaugel. Link intervjuule

-

Suurbritannia täielik kaubandusbilanss tuli oktoobris oodatud -£4,45 miljardi asemel -£3,9 miljardit, kuid ilma teenusteta oli oodatud -£8,1 miljardi asemel -£8,53 miljardit.

Naelsterling on Aasia sessiooni tõusu käest andnud ja kaupleb dollari suhtes 0,38% madalamal $1,5743 juures.

Kell 14.00 teeb Inglismaa keskpank teatavaks oma intressimäära ja stiimulprogrammi mahu otsuse. -

Fitch alandas Iirimaa reitingu BBB+ peale ja väljavaated on "stabiilse" peal.

-

Mõned mõtted Marc Faberi detsembrikuu GBD raportist:

What concerns me in equity wonderland is that investors have become extremely positive about future price gains. Based on seasonal factors (usually stocks perform well between October/November and May of the following year), the presidential cycle, QE2, strong corporate earnings, and their relatively attractive stock market valuation compared to long-term treasuries and cash, everyone seems quite comfortable holding equities. However, I ask myself to what extent the market may already have discounted all these positive factors, since all investors know about them by now. Moreover, the people who don’t seem to share the widespread optimism are usually the well-informed corporate insiders. In the week when the S&P 500 reached its yearly high at 1227 (Nov 5), they sold the most shares since the April 26 high (S&P500: 1219).

Earlier, I mentioned that I expected the Euro to weaken against the US dollar. As I have explained in the past, US dollar weakness is favorable for asset markets, whereas US dollar strength is negative for asset prices. Since my expectation is for the dollar to rebound somewhat further against all currencies, I am vacillating between being very cautious and being negative about equity markets for the next few months. Personally, I am continuing to reduce my exposure to equities, although I need to mention that, for the first time since 2005, I bought some Vietnamese shares. I also added some exposure to the Japanese stock market. Should US dollar strength carry on, Japanese shares could be one of the few asset classes that are not correlated to other world stock markets and commodities.

Despite my near term caution, I need to add one more point. I don’t think that Mr. Bernanke and other central bankers around the world have any intention of ever implementing an “exit strategy”. Maybe on paper the intention is there.

-

Inglismaa keskpank jättis intressimäära 0,5% peale ja stiimulprogrammi £200 miljardi peale, vastavalt ootustele. GBPUSD erilist reaktsiooni ei näita veel.

-

Faberi mõtete jätkuks, et Bull/Bear ratio on viimase paari kuuga jälle rõõmsalt 2,5-st üle kerinud. Üldiselt peaks juba 2.0 tase liigoptimistlikku sentimenti peegeldama ja mõistliku investori mõnevõrra murelikuks muutma.

-

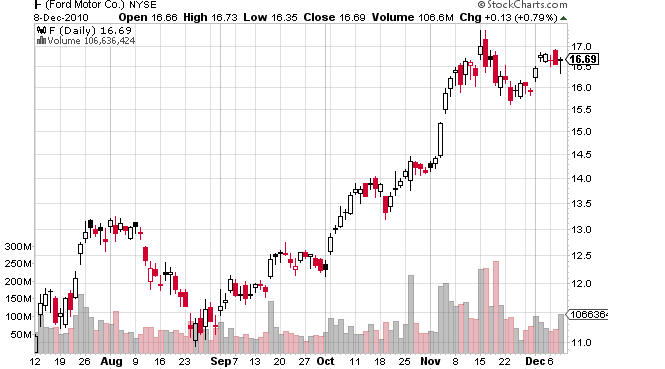

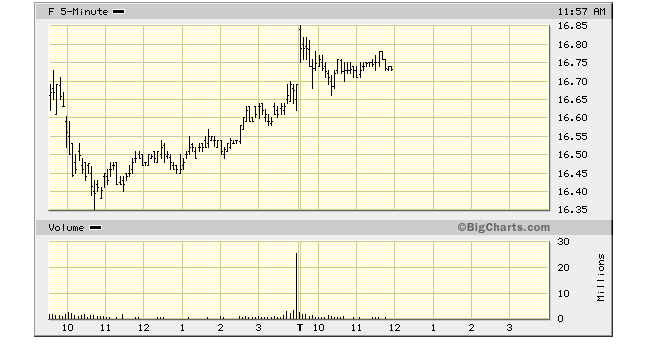

Täna on Merrill Lynchi analüütikud väljas positiivsete kommentaaridega Ford (F) kohta.

Merrill Lynch tõstab F aktsia hinnasihi $20 pealt $24 peale, mis ühtlasi tähistab ka uut street high`d.

Analüütikud usuvad Fordi jätkuvasse edusesse mitmel erineval põhjusel:

Solid results should continue

Ford’s financial performance over the past year has been impressive, with LTM EPS of $2.05 and automotive cash flow generation of ~$6.5bn. We expect the company to continue generating solid pre-tax profits in North America and in Ford Motor Credit, and stable/improving international performances to bolster results.Analüütikute sõnul on Fordi viimase aasta finantsnäitajad olnud muljetavaldavad ning nad ei näe ühtegi põhjust, mis see nii jätkuma ei peaks.

Balance sheet getting stronger each quarter

Ford has made meaningful progress in shoring up its balance sheet, and we expect further improvement ahead. Our current estimates imply that Ford will be comfortably net cash positive in 2011 and FMCC remains significantly over capitalized, which should drive higher value for shareholders.Bilansileht on iga kvartaliga läinud aina paremaks ning analüütikud usuvad, et 2011. aastaks on firmal piisavalt vaba raha.

Product sweet spot and common platform leverage ahead

We believe Ford is entering the sweet spot of its product cadence in MY11-MY1. We are forecasting an Annal U.S. replacement rate of ~30% for Ford during this timeframe, and expect greater use of common platforms/parts to drive significantly lower engineering costs.Analüütikute arvates on ettevõte sisenemas magusasse tootetsüklisse ning järgnevate aastate jooksul prognoosivad analüütikud Ford-le USA aastaseks asendusmääraks ca 30% ning ühtlasi eeldatakse ka suuremat ühisplatvormide/autoosade kasutamist, mis märkimisväärselt vähendaks arenduskulusid.

Solid leadership at the top

It is difficult to measure the short-term success of a management team in them, automotive industry, as so much is dependant upon the economic cycle. However, we believe Alan Mulally has led Ford through what is likely the worst of the downturn, and has positioned the company for success as volumes recover.Fordi juhtkond ja eriti firma CEO Alan Mulually on vedanud ettevõtte läbi väga raskest olukorrast. Kuigi lühiajalist edu on raske mõõta, siis Mulually on igal juhul loonud ettevõttele soodsa pinnase parandada tulemusi ka tulevikus.

Ford on viimase paari kuu jooksul kahtlemata kõige populaarsem aktsia olnud. Väga mitmed suured analüüsimajad nagu Morgan Stanley ja UBS on firma suhtes äärmiselt positiivselt meelestatud ning täna kinnitab oma ootusi firma suhtes ka Merrill Lynch.

Kauplemise seisukohast on Merrill Lynchi hinnasihi muutus natuke keeruline, sest F on viimase paari kuu jooksul teinud aina uusi tippe ning mäletatavasti ei pakkunud aktsia kauplejatele sugugi oodatud liikumist, kui 1.novembril tuli uue hinnasihiga ning positiivsete kommentaaridega välja Morgan Stanley.Hetkel kaupleb aktsia $16,90 kandis, ca 1,3% plusspoolel.

-

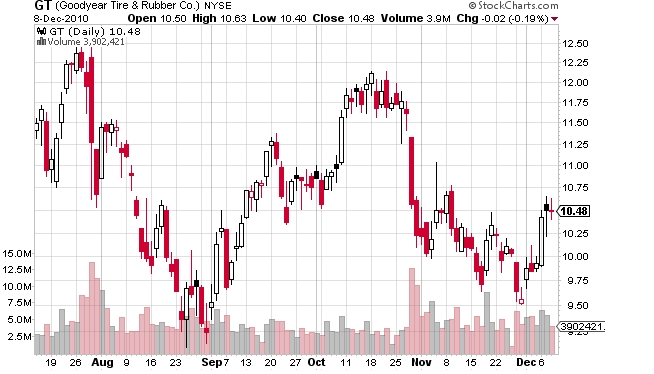

Teine call, mis mulle täna silma jäi, on samuti Merrill Lynchi analüüsimeeskonna poolt.

Nimelt tõstavad analüütikud Goodyear Tire &Rubber (GT) aktsia reitingut „müü“ pealt „osta“ peale koos $12,50 hinnasihiga.

As part of our sector review (please see our recent note,Changing lanes – still accelerating), we have determined that GT’s valuation has become more attractive. Year-to-date the stock is down about 28%, which is significant relative to the other auto stocks, and appears a result of balance sheet concerns and lackluster results, which remain material risks. However, we believe this pressure may begin to ease in coming quarters and as GT potentially further addresses its balance sheet. Therefore we are upgrading GT from Underperform to Buy vased on valuation.

Tegemist siis on eelkõige reistingutõstmisega valuatsiooni baasul ning analüütikud usuvad, et aktsiahind on hetkel muutunud üsna atraktiivseks. GT on võrreldes autosektoriga oluliselt nõrgemalt esinenud , kuid analüütikud usuvad, et lähitulevikus surve aktsiale väheneb.

Increase in miles driven demands tire replacement

Miles driven is nearing the all-time high of 3 trillion miles on an annualized basis. With vehicle replacement still running low, we believe the increase in miles driven requires drivers to replace certain parts of the car, none more so than tires, and Goodyear should benefit from the improvement in replacement tire volume. It should be noted that our thesis of new vehicle sales recovery does not undermine our replacement tire growth assumptions. Although new vehicle sales will likely pick up, with almost 250 million vehicles in operation, 15 million new vehicles would only replace 6% of the fleet, which will likely continue to age.Aasta baasil on sõidetud miilide arv saavutamas oma haripunkti ( 3 triljonit miili), mis viitab sellele, et autojuhid peavad hakkama välja vahetama oma autokumme. 250 miljonist autost ainult 6% on uued autod, mis annab alust oletada, et uute autode müük jätkab kasvu.

Pricing supportive, raw mats remain a risk

Pricing for the tire companies is also strong, as companies collectively pass on increasing raw material costs to the consumer. Recently several price increasesm have been announced by the major tire manufacturers. Further raw material increases, beyond what we are modeling for GT, remain a risk. However, generally Goodyear has been able to effectively pass this cost through.Toormaterjali hinnad on tõusuteel ja mitmed suuremad rehvitehased on hiljuti hindu tõstnud. Olgu öeldud,et edaspidine hinnatõus võib GT-le teatavat riski kujutada, kuid üldiselt on firma suutnud taolist kulu tõhusalt käsitleda.

Gt puhul pole küll tegemist väga isuäratava hinnasihiga, aga usun, et vaatamata sellele leiab GT täna ostuhuvi, sest koos positiivse väljavaatega autotööstuses saab oma osa sellest kasvust kindlasti ka GT. Aktsia on võrreldes sektoriga pigem nigelalt liikunud ning üsna negatiivse sentimenti taustal köidab positiivne reitingumuutus ilmselt turuosaliste tähelepanu.

Hetkel kaupleb aktsia $10,87 peal, 3,7% plusspoolel.

-

Initial Claims 421K vs 429K Briefing.com consensus; prior revised to 438K from 436K

Continuing Claims falls to 4.086 mln from 4.4277 mln -

Gapping up

In reaction to strong earnings/guidance: LULU +10.2%, ONP +9.8%, ASML +4.8%, HITK +4.6%, SFD +4.5%, DMND +4.1%.

M&A news: ZQK +13.4% (higher following French newspaper story suggesting PPR interested In buying the company), DELL +0.7% (Compellent Technologies and Dell engaged in advanced discussions in which Dell would acquire all of the outstanding common stock of CML at a price of $27.50/share in cash ).

Select financial related names showing strength: IRE +8.2%, BLK +3.6% (presented at Goldman Sachs Financial Services Conference: says in Q4 earnings and margin are going to be very strong), RBS +2.0%, PUK +1.9%, ING +1.8%, DB +1.8%, BCS +1.4%, BAC +1.3%, CS +1.1%, HBC +1.1%, C +1.0%, UBS +0.9%.

Select metals/mining stocks trading higher: IVN +2.8%, FCX +2.8% (declares $1.00 per share supplemental common stock dividend and two-for-one stock split), BHP +1.3%, NGD +1.1%, BBL +1.0%, HL +1.0%.

Other news: OCZ +13.9% (secured mass production quantity orders), SWS +11.0% (announces termination of $95 mln convertible senior notes offering ), SIRI +10.7% (strength attributed to reports that Howard Stern plans to extend contract), YOKU +6.2% (new IPO), TEVA +5.5% (provides successful results of Phase III study with oral laquinimod for multiple sclerosis), ENTR +3.2% (jumped to highs yesterday after Fortune managing editor discussed stock on CNBC as one of their Top 10 for 2011), GT +2.9% (attributed to upgrade at tier 1 firm), F +1.5% (strength attributed to tier 1 firm raising ests), UIL +1.1% and KMP +0.8% (Cramer makes positive comments on MadMoney), INTC +0.8% (CNET reports AAPL to use INTC graphics chips; added to short-term buy list at Deutsche Bank).

Analyst comments: SRE +1.8% (upgraded to Buy from Neutral at Goldman), SWC +1.3% (upgraded to Outperform from Sector Perform at RBC Capital), HD +0.8% (upgraded to Outperform from Market Perform at FBR Capital), AOL +0.6% (initiated with Buy at Needham), CETV +0.6% (upgraded to Buy from Hold at Deutsche Bank).

-

Gapping down

In reaction to disappointing earnings/guidance: SWHC -6.2%, SAI -3.5%, MATK -3.1%, CMTL -2.8%, OXM -2.5%, CAG -2.5%.

M&A news: CML -15.8% (Compellent Technologies and Dell engaged in advanced discussions in which Dell would acquire all of the outstanding common stock of CML at a price of $27.50/share in cash).

Other news: SDTH -11.3% (ticking lower; ShengdaTech prices $90 mln senior convertible notes due 2015), AGNC -6.5% (to sell 8,000,000 shares of its common stock to Citi and Deutsche Bank), XNPT -6.3% (prices 4 mln shares of common stock at $7.15), QXM -5.0% (is currently seeking to retain a new investment banking firm to act as its financial advisor in connection with the Special Committee's evaluation of the proposed acquisition by Qiao Xing Universal Resources), TTM -4.6% (traded lower overseas), EGY -4.3% (commences first production from Etame 7H development well; the well will be logged, plugged and abandoned), LINE -4.3% (announces a 10 mln unit offering pursuant to an existing shelf), OXPS -4.2% (still checking; continuing yesterday's pullback from 52 week highs), EQY -4.1% (announces offering of 8 mln shares of common stock), ALV -4.0% (expands in China increases by 50% its capacity for safety electronics), NVDA -3.4% (CNET reports AAPL to use INTC graphics chips; would push out NVDA), LSE -3.3% (announced that it may sell up to 9 mln shares of its common stock), SNH -3.2% (announces proposed public offering of 10 mln common shares), HFWA -3.0% (announces a $45 mln common stock offering; may also seek approval utilize a portion of the proceeds of this offering and other available cash to repurchase all or a portion of the $24.0 mln of preferred stock it issued to the U.S. Treasury under the TARP), SI -2.2% (under pressure following Austrian newspaper Kurier report that OeBB Holding is not ordering Railjets), AKAM -1.9% (Akamai Tech CEO presenting at investor day).

Analyst comments: PAYX -1.1% (downgraded to Market Perform from Outperform at Wells Fargo), UA -0.6% (downgraded to Neutral from Buy at Sterne Agee).

-

EURUSD on taastunud riskisoovi toel kogu päevasisese kaotuse tagasi teinud ja kaupleb avanemistaseme 1,3255 juures.

-

USA indeksite futuurid indikeerimas avanemist 0,4-0,5% kõrgemal. EUR/USD -0,05%@1,3255, nafta +0,67% @ 88,88 USD, kuld +0,56%@1390 USD

Euroopa turud:

Saksamaa DAX +0,18%

Prantsusmaa CAC 40 +0,77%

Suurbritannia FTSE100 +0,49%

Hispaania IBEX 35 +1,27%

Rootsi OMX 30 -0,74%

Venemaa MICEX +0,77%

Poola WIG -0,03%Aasia turud:

Jaapani Nikkei 225 +0,52%

Hong Kongi Hang Seng +0,34%

Hiina Shanghai A (kodumaine) -1,32%

Hiina Shanghai B (välismaine) -1,09%

Lõuna-Korea Kosdaq +0,73%

Austraalia S&P/ASX 200 +0,88%

Tai Set 50 +1,10%

India Sensex 30 -2,31% -

Rev Shark: Stay Focused

12/09/2010 9:02 AMContent makes poor men rich; discontent makes rich men poor.

-- Benjamin FranklinAlthough the market has had good reason to correct lately, market players are quite content with the current state of affairs and see little reason to exit the market. While there is still much political wrangling, a market-friendly tax deal is in place; plus, the fears over European sovereign debt have cooled and last week's poor employment report have been quickly forgotten. Even the extended technical conditions have been alleviated after two days of flat action.

Probably the most frustrating aspect of this market since the low in March 2009 has been how few opportunities there have been to enter new positions on pullbacks. We have seen a few drops along the way but once the market starts to trend upward, it does so consistently in a straight line. There is little hesitation to buy, and if you aren't willing to chase entry points, you have been left out to a great extent.

The recent move over the last six days has been a good example. Once the S&P 500 started to bounce on Dec. 1, the market just went straight up until we made a new two-year high. There was no hesitation and, although the market reversed a bit intraday on Monday, it is still at closing highs.

The best way to deal with this sort of market is to simply avoid being too bearish. The single biggest mistake you could have made over the past 18 months is to constantly look for turning points. It is the folks who keep looking for the market to reverse who are constantly frustrated and end up serving as additional fuel to keep the move going.

The ironic thing about this is that the poor economic situation for the last two years has provided many good reasons to stay bearish. Obviously, the unemployment situation is still terrible and the real estate market remains a mess, but this market has chugged along so steadily you would never even think that we had any sort of ongoing economic problems.

I have found that the only way to deal with it is to stay focused on looking for long setups and not to be anticipatory at all when it comes to looking for a market reversal. These past two days have been a good illustration of how this market corrects. It doesn't go down much at all. It just runs in place for a while and the underinvested bulls never even allow it to dip much.

We have a positive open and a rather benign atmosphere. Quite often the bears will claim that market players are so content and sanguine that the market has to reverse. But if you have been looking for positive sentiment as a contrary indicator, it hasn't worked at all.

Given the current atmosphere, you can be pretty confident that dip-buyers won't be lurking too far under the surface.

At the time of publication Rev Shark had no positions in the stocks mentioned.

-

Kaks päeva tagasi sai veidi valgustatud SFD aktsia käitumist ning täna avaldati korralikud kvartali tulemused, aktsia +6.6% tõusus $18.88 tasemel.

Smithfield Foods (SFD) beats by $0.24, misses on revs (17.70 )

Reports Q2 (Oct) earnings of $0.80 per share, excluding non-recurring items, $0.24 better than the Thomson Reuters consensus of $0.56; revenues rose 11.4% year/year to $3 bln vs the $3.21 bln consensus. "Looking forward, continued strong fundamentals driven by reduced protein supplies, good export demand and management discipline will continue to propel very solid Pork segment earnings. In the Hog Production segment, raising costs will remain in the mid-$50's per hundredweight in fiscal 2011. Furthermore, we expect that there will be very little, if any, expansion in U.S. hog production in 2011. The outlook for corn supplies and prices is getting brighter. We are encouraged that support for ethanol produced from corn appears to have diminished in recent months. The ethanol blenders tax credit, which is set to expire this year, has come under increased scrutiny in the media and in Congress, and may be reduced or even eliminated." -

Oodatust paremad töötuabiraha tulemused on oma mõju kaotanud: EURUSD -0,7% ja kaupleb 2. detsembri tasemel 1,3170 juures.

-

The Fed purchased $8.31 bln of 2016-2017 maturities through Permanent Open Market Operations as dealers looked to put back $33.13 bln

-

Bloomberg TV reporting that House Democrats to vote against tax plan

-

Headlines crossing that House Democrats have blocked the tax plan vote-- Bloomberg TV

-

Tänases Reutersis räägivad fondijuhid ja tippinvestorid oma 2011. aasta soovitustest.

Näiteks BlackRock`i aktsiastrateeg Bob Doll ütleb, et temale meeldivad tehnoloogiaettevõtetest sellised firmad nagu IBM (IBM), Microsoft (MSFT), Western Digital (WDC), Seagate Technology (STX), energiaettevõtetest Marathon (MRO) ja ConocoPhilips (COP). Sektoritest toob ta eraldi välja finantsi ja esmatarbekaubad.

Mis puudutab valuutasid, siis näiteks Percival Stanion Baring Asset Management`st ütleb, et üritab eurot täiesti vältida, sest tema prognooside kohaselt on euro tulevik eurotsooni võlakriisi tõttu väga tume.

-

Fed releases Flow of Funds Data: Household wealth declines $1.2 trl in Q3

-

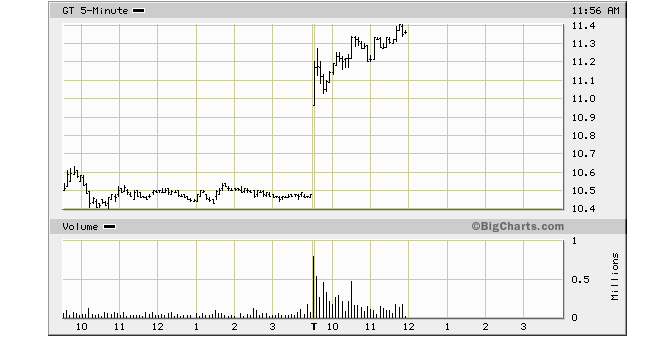

Täna võib öelda, et GT kauplemisidee töötas, aga seda oli keeruline kaubelda. Aktsiat pakuti eelturul $10,90 kandist, mis aga omakorda tähendas seda, et positsioon oleks tulnud soetada ca 4% kõrgemalt. See oli üsna riskantne otsus ja taolistes olukordades soovitaks soovitud kogust vähemalt poole võrra vähendada, kui ikkagi soovitakse ideed kaasa kaubelda. Aga aktsia on alates avanemisest teinud väga ilusa liikumise ning kaupleb hetkel $11,48 kandis, 9,5% plusspoolel. Esimese kümne minuti jooksul lubas aktsia ka kiire kasumi võtta, sest käis ära $11,25 tasemel.

F seevastu käitus täpselt nii nagu ma ka hommikul kartsin ehk samamoodi nagu Morgan Stanley hinnasihi tõstmise peale kuu aega tagasi. Teisisõnu osutus idee mitte kaubeldavaks ning aktsia tiksunud siiani $16,70 ja $16,80 vahel.

-

Olgu täpsustuseks lisatud, et GT tänase liikumise taga polnud ilmselt Merrill Lynchi reitingumuutus, vaid pigem tugev data, mis avaldatud täna hommikul Deutsche Banki analüütikute poolt.

U.S. light vehicle replacement tire shipments were up a very strong 7.9% yoy for RMA members in November, and the overall industry was up 9.2% yoy.

Nonetheless, the November sales trends appear to be very strong considering the difficult comparison from November 2009 (RMA shipments in November 2009 rose by 14.7%, and the total industry was up 4.6%).

-

$13 bln 30-yr Bond Reopening Results: 4.410% (Expected 4.477%); Bid/Cover 2.74x (Prior 2.31x, 10-auction avg 2.66x); Indirect Bidders 49.5% (Prior 38.4%, 10-auction avg 34.8%)

-

PIMCO tõstab USA majanduskasvu prognoose, põhjenduseks stiimulid.

-

Bloomberg TV reporting that PIMCO raises U.S. growth forecast on massive stimulus

-

iShares FTSE/Xinhua China: November China property prices rise 7.7% y/y, compared to 8.6% in October; slowest pace since 5.7% in November 2009

-

Alloleval graafikul on kujutatud MOVE indeks, mis on sisuliselt VIX indeksi analoog võlakirjaturule. Täna tõusis indeks ca 112 punktile ehk volatiilsus võlakirjaturul on võrreldav “flash crashi” (6. mai) jooksul nähtuga.