Börsipäev 21. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Sentiment on täna teinud 180-kraadise pöörde ning Aasia eesotsas Hiinaga alustamas päeva korraliku plussiga. Lõuna-Korea viis eile oma sõjaväeõppuse lõpule põhjustamata seejuures kardetud intsidenti Põhja-Koreaga. Hiina indeksid on täna aga kauplemas 2% lähedal, kui kinnisvaraarendajad said tuge möödunud nädala müügistatistikast ning energiatootjat kütte suurenevast nõudlusest.

Makrokalendrist ei ole tänagi midagi märkimisväärset välja tuua. Euroopa indeksite futuurid indikeerivad avanemist 0,5-0,7% kõrgemal, USA futuurid kauplevad hetkel 0,4% plusspoolel.

-

Moody's teatas, et Portugali reiting võetakse võimaliku langetamise osas vaatluse alla. Euro sattus surve alla.

-

Saxo Bank on igal aastal väljas konsensusest oluliselt radikaalsema nägemusega, prognoosides näiteks tänavuseks aastaks ühel või kahel kuul USA positiivset kaubandusbilanssi, USA sotsiaalkindlustusfondi pankrotti ning uue partei moodustamist, mis oleks pidanud USA kongressi vahelimistel kaarte korralikult segama. Kuid siinkohal ei saa eitada, et osa Saxo prognoosidest said ka tõeks: VIX-i kukkumine 14 lähedale (mullu detsembris ca 23 punkti), Saksa 10.a võlakirja yieldi langus 2,2% peale ( aasta tagasi oli tasemeks 3,2%). Sellised on Saxo prognoosid 2011. aastaks:

- US CONGRESS BLOCKS BERNANKE’S QE3

- APPLE BUYS FACEBOOK

- US DOLLAR INDEX TOPS 100

- US 30-YEAR TREASURY YIELD SLIDES TO 3%

- AUSSIE-STERLING DIVES 25%

- CRUDE OIL GUSHES BEFORE CORRECTING BY ONE THIRD

- NATURAL GAS SURGES 50 PERCENT

- GOLD POWERS TO USD 1800 AS CURRENCY WARS ESCALATE

- S&P500 REACHES AN ALL-TIME HIGH

- RUSSIA’S RTS INDEX REACHES 2500

Loe pikemalt siit

-

Doug Kass on viimase kuu jooksul esitanud CNBC eetris oma 2011.a nägemusi, millest üks üllatavamaid tuli ilmselt eile. Erinevalt paljudest analüüsimajadest leiab Kass, et kuld saab olema järgmise aasta kõige halvema tootlusega varaklass ning untsi hind võib mingil hetkel liikuda 25% madalamal tänastest tasemetest. Link

-

Paari sõnaga veel võimalikust Portugali reitingu alandamisest Moody's poolt. Põhjuseks toodi Portugali majanduse seisund pikemas perspektiivis, mis võib kannatada valitsuse kärbete tõttu. Lisaks toodi välja kahtlused valitsuse võimes kaasata raha otse turgudelt jätkusuutliku hinnaga. Üheks probleemiks on ka Portugali majanduse loid taastumine. Portugali maksevõimetuse küsimus ei ole Moody's sõnul tõenäoline.

-

Suurbritannia valitsuse novembrikuu defitsiit £16,8 miljardit vs oodatud £12,3 miljardit. Avaliku sektori laenukoormus kasvas novembris £22,8 miljardit vs oodatud £16,8 miljardit. Naelsterling sattus surve alla ja on kaotanud dollari vastu kogu päevasisese tõusu, kaubeldes $1,5515 tasemel.

-

Euro on viiel järjestikkusel päeval teinud Šveitsi frangi suhtes uue kõikide aegade põhja. Täna on euro langenud -0,28% ja põhi tehti 1,2617 tasemel.

-

Tänased huvitavamad upgrade/downgrade

Upgrades:

TW Telecom (TWTC) - Citi

Cardinal Health (CAH) - Target and estimates increased at Credit Suisse

McKesson (MCK) - Target increased at Credit Suisse

ArcelorMittal (MT) - Target increased at Credit Suisse

Boeing (BA) - Added to short-term buy list at Deutsche BAnk

Adobe Systems (ADBE) - Target increased at Goldman

Thoratec (THOR) - UBS

Check Point Software (CHKP) - Estimates increased at Wells Fargo

Harley-Davidson (HOG) - Valuation range increased at Wells Fargo to $39-$41 (from $36-$39)

Downgrades:

Urban Outfitters (URBN) - Brean, Murray, Carret

El Paso Electric (EE) - Jefferies

BBY on peale kvartalitulemusi kõvasti pihta saanud, täna on Janney Montgomery väljas oma reitingu kinnitusega-> BUY ja target $53 Positiivse turu taustal võiks liikuda kergelt kõrgemale.

-

Gapping up

In reaction to strong earnings/guidance: ADBE +7.1%, JBL +6.2%, WBC +4.2%, KMX +2.1%, PAYX +0.7%.

M&A news: LCRD +39.3% (LaserCard to be acquired by ASSA ABLOY for $6.25/share), MATK +34.0% (Martek Biosci to be acquired by Royal DSM for $31.50 per share in cash for total consideration of $1.087 bln), MEE +2.7% (seeing strength following reports that ANR made a bid for co).

Select financial related names showing strength: RBS +3.6%, IRE +3.5%, IBN +2.8%, BCS +2.0%, STD +1.6%, BBVA +1.6%, HBAN +1.3%, CS +1.1%, AIG +1.1%.

Select metals/mining stocks trading higher: RIO +2.1%, BBL +1.7%, BHP +1.5%, FCX +1.2%, VALE +0.7%.

Select oil/gas related names showing strength: KOG +2.3%, RIG +1.3%, WFT +1.2%, REP +1.0%, STO +0.9%, TOT +0.8%.

Other news: IVAN +21.7% (announces significant natural gas discovery at Yixin-2 well on Zitong Block in China), INCY +5.4% (announces positive top-line results from COMFORT-I Pivotal Phase III Trial of INCB18424; trial meets primary and key secondary endpoints), IRE +5.1% (still checking), BLDP +3.4% (to power one megawatt fuel cell generator in Singapore), MCP +3.2% (Molycorp and Hitachi Metals to form joint ventures for the production of rare earth alloys and magnets ), MGIC +2.6% (modestly rebounding, also Techno Net Work Chooses Magic Software's uniPaaS to Develop Cloud-based Applications), FRO +2.1% (still checking), .

Analyst comments: TWTC +1.8% (upgraded to Buy from Hold at Citigroup), IGTE +1.7% (initiated with an Outperform at Oppenheimer), AMZN +0.7% (initiated with Outperform and $205 tgt at Macquarie).

-

Gapping down

In reaction to disappointing earnings/guidance: DRI -3.7%.

Other news: KNDI -14.2% (announces registered direct placement of ~$16.6 million of common stock), CAST -5.1% (still checking), ROC -4.5% (filed for a common stock offering, which includes selling shareholders, for an indeterminate amount; then announced an 8 mln share common stock offering by selling shareholders), ARNA -4.6% (pulling back from yesterday's 44% jump), FNSR -3.7% (agrees to sell 3,600,000 shares of its common stock in an underwritten public offering), WBS -2.7% (filed for a 6.3 mln share common stock offering).

Analyst comments: SKX -5.2% (downgraded to Sell from Buy at Sterne Agee), PSUN -4.3% (light volume; downgraded to Sell at Wall Street Strategies following checks), URBN -1.6% (downgraded to Hold at Brean Murray), MD -0.9% (downgraded to Hold from Buy at Deutsche Bank).

-

USA indeksite futuurid indikeerimas avanemist 0,4% kõrgemal. EUR/USD +0,29% @1,3265, kuld -0,15% @1384 USD, nafta -0,06% @89,3 USD.

Euroopa turud:

Saksamaa DAX +0,81%

Prantsusmaa CAC 40 +0,92%

Suurbritannia FTSE100 +0,85%

Hispaania IBEX 35 +1,77%

Rootsi OMX 30 +0,90%

Venemaa MICEX +0,49%

Poola WIG +0,63%Aasia turud:

Jaapani Nikkei 225 +1,51%

Hong Kongi Hang Seng +1,57%

Hiina Shanghai A (kodumaine) +1,80%

Hiina Shanghai B (välismaine) +1,19%

Lõuna-Korea Kosdaq +1,75%

Austraalia S&P/ASX 200 +0,75%

Tai Set 50 +0,86%

India Sensex 30 +0,86% -

Rev Shark: Stay Focused

12/21/2010 9:03 AMIf you don't like something change it; if you can't change it, change the way you think about it.

-- Mary EngelbreitThe S&P500 has been up for 12 of the last 14 days and is set for another positive open this morning. Overseas markets were quite strong overnight as China was less aggressive in making some inflation fighting moves than expected and tensions eased between North and South Korea. A strong earnings report from Adobe Systems (ADBE - commentary - Trade Now) is adding to the positive mood.

It is rather fitting that the year is ending with the sort of market action that has been so common since the low in March 2009. We have seen a series of these rallies in which the market goes straight up with long streaks of multiple positive days. We saw a stretch from February through April and then from September through November. In both cases, the market had strong runs with no pullbacks. In March, it had one run in which the S&P500 was up 14 days in a row.

If you look back at the market action over the last 10 years or so, you will see plenty of uptrends but very few stretches in which the market went up in such unrelenting fashion. Even the strongest runs would have some pullbacks and rest before the market would resume rallying.

These straight up moves are what can make the market so difficult even for those folks who are steadfast in their bullishness. You are constantly required to try jump on a moving train if you want in. Of course a buy and hold approach, especially if you are in the right stocks, is the big winner in this sort of market which is ironic after so many people declared the approach to be complete dead after the meltdown of 2008.

Too many market players insist on fighting this sort of market action. Rather than adjust their thinking and their approach, they keep acting as if the market will change what it is doing simply because they want it too. You aren't going to win any battles with the market beast. The only thing you can do is change your thinking if you are not having much success.

Lately I've been repeating the same piece of advice quite often but it is what is working: Avoid the temptation to keep trying to call a top and stick with the trend until there is some actual price weakness. The bears have been trying to anticipate a top for weeks now and they keep on being badly abused by the market beast. Yes, there are plenty of reasons why this market should correct and the fact that it is more and more extended each day just adds to the logic of the anticipatory bears, but it isn't happening.

Not only are the bears racking up losses on their short positions but they are missing out on the positive opportunities that continue to occur. That is the biggest danger of a trend fighting approach. If your timing is off, you will not only have losses on your short positions but you will also miss out on gains from long positions.

Timing is always the key to market success and there is just no easy way to time when a trend will come to an end. That has proved especially true in the market during the last two years in which we have such stubborn and steady uptrends. So forget the timing and stay focused on the price action. The price action will take you out of the market at some point when the market finally does correct but in the meantime, just keep trying to pad your gains, so you have a big cushion when the trend finally does shift.

We are seeing a good size gap this morning, which should invite some quick profit-taking. But, as we saw yesterday, the dip buyers were lurking about and were pleased to buy the weakness. With the dollar weak this morning, the dip buyers should be anxious to jump in once again. That is, if they even have an opportunity.

The trend remains our friend.

At the time of publication, Rev Shark had no positions in stocks mentione

-

The Fed purchased $7.79 bln of 2016/2017 maturities through Permanent Open Market Operations as dealers looked to put back $18.22 bln

-

BBY ei tööta ja müügipress jätkub tavapärases rütmis.

-

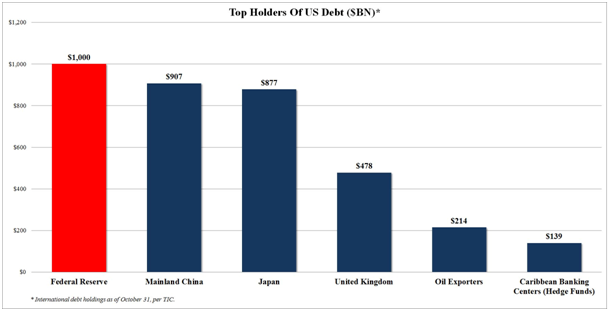

Föderaalreservil on tänase esimese POMO järgselt valitsuse võlakirjasid $999 miljardi eest.

-

FCC passes 'net neutrality' rules in a 3-2 vote, as expected

-

Rahvaloenduse andmete kohaselt kasvas USA rahvaarv võrreldes 2000. aastaga 9.7%, olles 308 745 538. Tegu on väikseima kasvuga alates 1940. aastast. Kõige rohkem kasvas rahvastiku arv Lõuna ja Lääne osariikides, mis saavad seeläbi endale Kongressis 11 täiendavat kohta. Need kohad tulevad Kirde ja Kesk-Lääne osariikide arvelt ehk osariikidest, kus Obama 2008. aasta presidendivalimistel võidutses. Seega võib antud areng parandada 2012. aasta presidendivalimistel vabariiklaste võimalusi. (link)

-

Amazon.com Inc Said to exceed Kindle sales forecast by 60%, on pace to sell 8M units in 2010 - US financial press

-

As expected, Senate passes govt spending extension bill

-

Meredith Whitney on CNBC discusses state/municipal funding situation

Meredith Whitney on CNBC says states have been funding the municipal govt expenditures, and as states become more compromised and the Federal govt funding runs out, you'll see indiscriminate selling, and the prices for all municipals rise. -

Pärast tänast teist POMOt ületab Föderaalreservi omanduses olevate valitsuse võlakirjade koguväärtus $1 triljoni piiri ja Fed ühtlasi suurim võlakirja omaja. Järgnevad Hiina ja Jaapan (graafik Zerohedgi vahendusel):

-

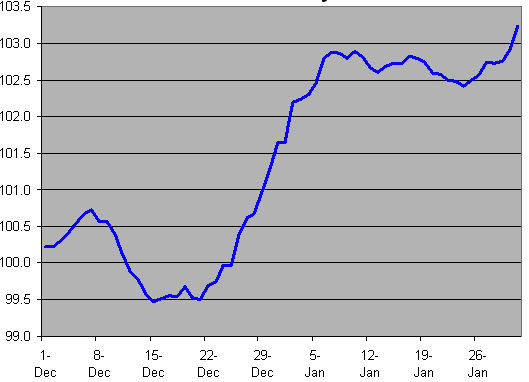

Kuigi varasemad aastad ei pruugi näidata turgude suunda ka käimasoleval aastal, siis ajalooliselt (aastatel 1896 – 2007) on DOW 30 indeks tõusnud vahemikul 22. detsember kuni 7. jaanuar keskmiselt 3.39%. Saame näha kas ka tänavu “jõuluvana ralli” tuleb.

-

Kas on graafik vigane või periood vigane? Igaljuhul graafikul on näha periood 1 dec ... 26 jan

-

Seal sa näed selgemalt, et periood 22.12-07.01 on toimunud liikumine.

-

Või siis pigem, et Dec on liikumine olnud ja Jan ei ole olnud.

-

Või siis pigem, et detsembri liikumine on jaanuari omast nõrgem.

-

Liikumine toimunud ikkagi ajavahemikul 22. detsember kuni 7. jaanuar - pikem periood on lihtsalt selleks, et tõusu paremini "illustreerida"