Börsipäev 21. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Nädala viimane päev jääb makro osas vaikseks ning suuremat huvi peaksid pakkuma vaid Saksamaa IFO indeksid (kell 11.00), mille koondnäitaja võis analüüsimajade arvates teha jaanuaris uue tipu. Lisaks avalikustatakse Suurbritannia detsembrikuu jaemüügi numbrid (kell 11.30). Enne USA turgude avanemist on oodata Bank of America, General Electricu ja Schlumbergeri majandustulemusi.

Euroopa indeksite futuurid indikeerivad avanemist 0,2-0,4% kõrgemal, USA omad viibivad aga hetkel 0,1% jagu punases. -

Tulemuste tabel on jällegi uuendatud ja nähtav siin.

Eile peale turu sulgumist teatas oma kvartalitulemused Google (GOOG), mis osutusid oodatust küll paremaks, aga järelturul oli aktsia reaktsioon siiski üsna leige, mis osaliselt võib olla seletatav muudatustega ettevõtte juhtkonnas.

Starting from April 4, Larry Page, Google Co-Founder, will take charge of Google's day-to-day operations as Chief Executive Officer. Sergey Brin, Google Co-Founder, will devote his energy to strategic projects, in particular working on new products. -

Äsja avaldati Saksamaa IFO indeksid:

ärikliima indeks 110,3 vs oodatud 109,9 punkti;

hetkeolukorra indeks 112,8 vs oodatud 113,2 punkti; ja

ootuste indeks 107,8 vs oodatud 106,5 punkti.

Euro kaupleb 0,55% kõrgemal $1,3545 juures. -

Suurbritannia detsembrikuu jaemüük tuli vastavalt ootustele -0,3% (M/M), kuid aastane kasv oli 1% vs oodatud 1,3%.

Naelsterling on kerge surve all, kaubeldes -0,04% madalamal $1,5890 juures. -

General Electric prelim $0.36 vs $0.32 Thomson Reuters consensus; revs $41.38 bln vs $39.90 bln Thomson Reuters consensus -

Bank of America prelim $0.04 vs $0.14 Thomson Reuters consensus; revs $22.67 bln vs $24.87 bln Thomson Reuters consensus

Järgmise nädala jooksul avaldame pikema kommetaari ka Pro all -

Täna on Credit Suisse analüütikud väljas positiivse reitingumuutusega CarMax (KMX) kohta.

Nimelt tõstavad nad CarMax (KMX) aktsiareitingut „hoia“ pealt „osta“ peale ja hinnasihi $28 pealt $39 peale.

CarMax is one of the best growth stories and operates among the strongest and most protected business models in our space and possibly in all of retail.

Our enthusiasm for CarMax starts with a view that tighter new car inventories will keep new and used prices stable to rising even as SAAR picks up. In the past, excess production would lead to periods of depressed new car pricing which in turn would weigh on gross margins and average ticket. Today, car manufacturers are much closer to just in time production, producing based on their view of demand, not on their view of plant utilization. That should create a much more consistent underlying margin story for the used vehicle market and KMX.

Analüütikute sõnul on CarMaxi puhul tegemist tugeva ja kõige enam kaitstud ärimudeliga jaemüügisektoris üldse.

Credit Suisse usub firmasse juba seetõttu, et piiratud uute autode varud hoiavad uute ja kasutatud autode hinnad stabiilsena. Enne viis ületootmine autohinnad alla, mis omakorda pani ka marginaalid surve alla, aga täna lähtuvad autotootjad pigem nõudlusest mitte tootmisvõimsuse utilisatsioonist. See peaks omakorda kasuks tulema ka kasutatud autode turule ning sealhulgas siis ka CarMaxile.

CarMaxi olen tutvustanud LHV foorumlastele varemgi ning KMX näol on tegemist väga huvitava ettevõttega. Lähemalt saab lugeda firmast siin. Ka Credit Suisse analüütikud viitavad firma unikaalsele ärimudelile ning usuvad, et aktsial on piisavalt veel tõusupotentsiaali. Kauplemise seisukohast on $39 hinnasiht nüüd natuke lahja ja aktsia on alates suvest juba 80% tõusnud ehk siis tõusuruum ilmselt on vähemalt lühiajaliselt üsna limiteeritud. Sellise calli toimimine sõltub üsna palju ka turust, nii et turu toega võiks aktsia siiski turuosaliste huvi äratada. -

Täna on Credit Suisse analüütikud väljas positiivse reitingumuutusega Rockwell Collins (COL)-i kohta.

Credit Suisse tõstab COL reitingu „hoia“ pealt „osta“ peale ja hinnasihi $72 pealt $85 peale.

Well Positioned for Late Cycle Recovery: We have avoided COL due to it higher relative exposure to defense (62%) and the lagging biz jet mkt (17%). But, while defense growth could moderate, most negative news has passed for COL & we think the mkt is now ready to recognize that upside in Comm’l sales & margins drives a favorable risk/reward scenario. Despite a recent run in shares, COL still lags other aero suppliers, trading at an 8% discount to peers v. the 10% historical premium.

Analüütikud on otsustanud aktsiale osta soovituse anda nüüd, kuna usutakse, et halvad uudised on nüüdseks aktsiahinda sisse arvestatud ning turg oskab paremini hinnata firma võimalusi. Vaatamata hiljutisele rallile, on aktsia endiselt võrreldes konkurentidega 8% kehvemini esinenud.

Gov’t – Diverse Positioning Should Allow Above Mkt Growth: We think COL’s defense avionics/electronics gov’t biz should outgrow a flat-to-down DoD budget, even if retrofits gain favor over new a/c buys as it participates on both. Share gains, Int’l and adj. markets also offer higher org. growth potential. COL’s integrated business model allows it to earn comm’l margins in 50% of its defense business, making it uniquely profitable versus peers.

Analüütikud usuvad, et firma integreeritud ärimudel lubab teenida 50% marginaale selle riigikaitse ärisegmendis, mis omakorda teeb ettevõtte võrreldes konkurentidega väga kasumlikuks.

COL teatas ka eile oma kvartalitulemused, mis olid ootustest paremad ning ühtlasi tõstis prognoose käesolevaks aastaks. Credit Suisse uus $85 hinnasiht on ka kõrgeim hinnasiht ning arvestades seda, et sentiment on viimasel ajal firma suhtes olnud pigem negatiivsete killast, siis võiks aktsia minu arvates täna turul ostuhuvi leida. -

Kanada novembrikuu jaemüük 1,3% vs oodatud 0,4%. Eelmise kuu näit korrigeeriti üles 1,0% peale. USDCAD -0,4% 0,9930 juures.

-

Gapping up

In reaction to strong earnings/guidance: PLCM +13.7%, ISRG +12%, GE +4.4%, TPX +2.9%, MXIM +2.5%, AMD +2.2%, SLB +2%, GOOG +1.5%, SWKS +1.4%, WPI +1.2%.

M&A news: DNBK +29.3% (to be acquired by People's United Financial in a 55% stock and 45% cash transaction valued at ~$493 million), WMG +27.1% (higher on reports the co is contemplating selling itself), NOVA +2.2% (to be acquired by Surgery Partners for $13.25 Per Share), SLE +0.8% (saw late strength on continued M&A speculation).

Select financial related names showing strength: RBS +6.8% (strength attributed to reports of possible earlier than expected exit from govt asset protection scheme), IRE 3.8%, STD 3.7%, ING 2.7%, BBVA 2.6%, IBN +2.5%, DB 2.2%, CS 2.2%, UBS 1.5%.

Select oil/gas names getting boost following SLB results: RIG +2.0%, NOV +1.9%, HAL +1.5%, WFT +1.2%.

A few ethanol names seeing early strength on reports the EPA is expected to allow E15 fuel (15% ethanol) in cars for models as old as 2001: BIOF +21.2%, PEIX +11.2%

Other news: LEI +11.1% (Lucas Energy says that the Hilcorp Energy Company operated Hagen EF No.1H Eagle Ford horizontal well is expected to be brought into production within the next two weeks), PULS +5% (Pulse Electronics confirms receipt of letter from Bel Fuse), GMXR +4.5% (GMX Resources announces 2010 year-end Haynesville/Bossier reserves; 2010 production and operations update), AHL +3.4% (will replace Baldor Electric in the S&P MidCap 400 index), HUGH +3.1% (continued strength following late reports that co hired an advisor), VSI +2.9% (will replace Volt Information Sciences in the S&P SmallCap 600 index), TI +2.8% (still checking), YMI +2.2% (announced that results were reported from a randomized Phase II gastric cancer study of nimotuzumab being conducted by its licensees), AIG +1.4% (reports out overnight related to positive comments from govt auditor).

Analyst comments: UN +1.3% (upgraded to Overweight from Neutral at HSBC Securities), RVBD +0.9% (initiated with an Overweight at JP Morgan), WAG +0.9% (upgraded to Buy from Neutral at SunTrust), ETN +0.4% (upgraded to Outperform from Neutral at Robert W. Baird). -

Gapping down

In reaction to disappointing earnings/guidance: CVU -13.1%, JNY -8.6%, SYNA -7.6% (also downgraded to Underperform from Hold at Needham, downgraded to Neutral from Overweight at JP Morgan), IGT -5.8%, PBCT -5% (also plans to acquire Danvers Bancorp in a 55% stock and 45% cash transaction valued at ~$493 million), MTXX -3% (also summarizes ongoing 'go-shop' process; board reaffirms recommendation), BAC -2.0%, ELX -1.7% (light volume), COF -0.9%, .

Select metals/mining stocks trading modestly lower: PAL -3.6% (N Amer Palladium says payable palladium production from the LDI mine for the year ended Dec 31, 2010, totaled 95,100 ounces, in line with its 2010 guidance), SLW -1.1%, AU -1.0%, GFI -0.9%, NG -0.9%, AUY -0.9%.

Other news: ACOR -18.2% (issues statement on European CHMP Decision on FAMPYRA; will work closely with Biogen Idec during the appeal process), VVUS -13% (provides regulatory update on QNEXA NDA: FDA requested that VIVUS assess the feasibility of analyzing existing healthcare databases), BCRX -3.9% (ticking lower, BioCryst Pharm discloses CFO, Stuart Grant, to resign effective 5/31/2011; Grant to spend more time with family following loss of son last year), BIIB -3.4% (receives negative opinion from the CHMP on FAMPYRA), ARR -2.6% (announces that it intends to offer shares of its common stock in an underwritten public offering), CORT -2% (is offering to sell shares of its common stock), BT -1% (still checking).

Analyst comments: NAT -1.1% (downgraded to Underweight from Neutral at JP Morgan), FRO -0.8% (downgraded to Underweight from Overweight at JP Morgan), FCX -0.8% (downgraded to Hold from Buy at Citigroup). -

Here Comes the Test

By Rev Shark

RealMoney.com Contributor

1/21/2011 8:45 AM EST

The difference between school and life? In school, you're taught a lesson and then given a test. In life, you're given a test that teaches you a lesson. -- Tom Bodett

Since the market bottomed in March 2009, the market has had a tendency to bounce right back just as it looked ready to break down. A few times we had a more severe correction (like last May and June), but generally the market has been able to find its footing and shake off negatives very quickly after just a few days of selling.

The market's character is about to be tested. We're going to see whether this was just another little selling squall that prematurely excited the longsuffering bears, or whether it's the start of a real change in market character.

Earnings season complicates the test in some ways as we jump around in response to various reports, but if we have a consistent "sell the news" theme, it makes it easier to see how the character of the market might be shifting.

This morning, good earnings from Google (GOOG) , GE (GE) , Schlumberger (SLB) and Intuitive Surgical (ISRG) have us off to a good start. The poor response to Apple's (AAPL) very strong report the other night is being forgotten as we focus on the more recent news.

The real test of a change in market direction always occurs on bounces. It is when the bounce attempts fizzle that a real change in the market trend occurs. Yesterday was a bit troubling because there was a very limited bounce attempt after the pounding we took on Wednesday. It was notable that the small-caps and the Nasdaq had poor breadth and very little bounce.

This morning we have a much more energetic bounce, which will be a good test. Will it be seen as an opportunity for stuck bulls to unload and for shorts to find entries? Or will it scare the pessimists who have been burned so often by "V"-shaped recoveries every time this market has pulled back?

One thing that adds to the difficulty is that the pullback of the last two days hasn't been long enough to produce many good setups. We just have a bunch of small-caps that have broken down and not found any good support. I imagine many market players have taken stops and are now sitting on high levels of cash. If the market comes roaring back, they will be scrambling to reload some longs.

I'm in the heavy-cash position myself, and I'm not inclined to do any major chasing on a bounce this morning. I want to see how the market handles this early bounce. I suspect a lot of bulls will become excited again very fast -- and that's been the correct response quite often -- but I'm not ready to bet on a "V"-shaped recovery just yet.

Stay on your toes and be ready to move. This market is finally giving us some better volatility, and we can profit from it if we're quick and nimble.

No positions. -

Usa indeksite futuurid on hetkel liikumas 0,4% kuni 0,7% rohelises

Euroopa turud:

Saksamaa DAX +0,97%

Prantsusmaa CAC 40 +1,71%

Suurbritannia FTSE100 +0,69%

Hispaania IBEX 35 +2,23%

Rootsi OMX 30 +1,18%

Venemaa MICEX +0,52%

Poola WIG +0,40%

Aasia turud:

Jaapani Nikkei 225 -1,56%

Hong Kongi Hang Seng -0,53%

Hiina Shanghai A (kodumaine) +1,41%

Hiina Shanghai B (välismaine) +1,05%

Lõuna-Korea Kosdaq-1,43%

Austraalia S&P/ASX 200-0,59%

Tai Set 50 -1,57%

India Sensex 30 -0,20% -

Möödunud nädala USA väikeinvestorite sentimendiindeks reedab, et pullid jätkavad domineerimist, kuid nende investorite osakaal, kes usuvad aktsiaturgude langusesse järgmise kuue kuu jooksul, on suurenemas. Bearish sentiment kerkis nädalaga 5,7 protsendipunkti võrra, märkides kõrgeimat taset alates 18. novembrist.

-

Buiness Insider`i vahendusel tuuakse ära Citi analüütikute investeerimisideed käesolevaks aastaks. Teiste hulgas soovitavad analüütikud osta Jaapani ja Austraalia pangaaktsiaid ning Venemaa, Korea ning Hiina aktsiaid.

-

The Atlantic toob mitme huvitava joonise abil välja, kuidas 2007. aasta detsembrist 2009. aasta juunini kestnud majanduskriis USAd muutnud on, võrreldes 2007. aasta näitajaid 2010. aasta lõpu omadega.

-

Bloombergi vahendusel:

"BOE says U.K. inflation will slow after temporary surge well below 2% target" -

Täna peab nentima, et ei COL ega ka KMX polnud selle turu jaoks piisavalt tugevad upgrade`d. COL avanes $64 kandis ehk ca 2% plusspoolel ning kukkus ka kohe $0,50 allapoole. Umbes $63,50 kanti on aktsia ka kauplema jäänud.

KMX oli mõnevõrra parem ehk avanemisel kiire tegutsemise korral oleks kasum ka laual olnud,aga samas kukkus aktsia kiirelt uuesti alla, mis iseenesest pole üllatav kuna oli arvata, et sellise tõusu läbi teinud aktsia mitte just kõige tugevamale upgrade`le jätkusuutliku tõusuga ei reageeri. Aktsia avanes $32,40 kandis ning vahetult peale avanemist käis ära ka $32,75 peal, aga nüüd kaupleb $32,20 kandis ehk 1% plusspoolel. -

The Fed purchased $8.36 bln of 2018-2020 maturities through Permanent Open Market Operations as dealers looked to put back $18.96 bln

-

Imax Corp Registers 2.72M shares for holders - filing

-

Mitmetes finantsblogides on täna ära toodud Shanghai 7 päeva Interbank Lending Rate ehk SHIBOR, mis on paari päevaga ca 2.5% pealt 7.4% peale tõusnud.

Siinkohal ei tahaks küll liigset pessimismi külvata, aga kui ühele ja samale graafikule lisada ka Shanghai Composite ja SHIBOR, siis on selgelt näga, millest juttu on (valge joon tähistab SHIBORi). -

CNBC vahendusel Reutersi uudis sellest, kuidas Föderaalreserv viis läbi paar muutust raamatupidamise meetodites, eesmärgiga kanda enda potentsiaalsed kaotused (erinevate võlakirjade hoidmisest) sisuliselt üle rahandusministeeriumile.

Concerns that the Federal Reserve could suffer losses on its massive bond holdings may have driven the central bank to adopt a little-noticed accounting change with huge implications: it makes insolvency much less likely.

The significant shift was tucked quietly into the Fed's weekly report on its balance sheet and phrased in such technical terms that it was not even reported by financial media when originally announced on Jan. 6.

"Any future losses the Fed may incur will now show up as a negative liability as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible," said Brian Smedley, a rates strategist at Bank of America-Merrill Lynch and a former New York Fed staffer.

Võttes arvesse, et Föderaalreserv on suurim USA võlakirjade omaja, on viimasel ajal olnud teemaks ka see, kas Fed võib tehniliselt minna pankrotti (võttes loomulikult arvesse ka seda, et Fed võib vajadusel raha juurde toota nii palju kui ise tahab). Siin Casey Researchi artiklis analüüsib Terry Coxon intressimäärade tõusust tulenevaid võimalusi Fedi tehniliseks pankrotiks. Muudatused raamatupidamise meetodites on selle sündmuse tõenäosuse sisuliselt nullini viinud. -

Kas on olemas ka mingit adekvaatset põhjust miks SHIBOR spikeb?

-

momentum, see on reaktsioon Hiina keskpanga reservmäära tõstmisele.

Rumours of a rate hike didn't help either. Following the increase in the Reserve Requirement Ratio, Chinese banks slowed or completely stopped interbank lending, which left some banks desperate for cash to pay the reserves. Domestic news reported that two banks failed to raise enough cash to pay the new reserve requirement ratio so the People's Bank of China made an unusual reverse repo to these banks (ie took collateral from the banks to make a cash loan).

-

Ma ei usu seda. RRR tõuse on tulnud tihedalt, siis pole nii ekstreemset reaktsiooni järgnenud. Siin peab olema mingi muu põhjus.

China tightens policy & signals yuan flexibility

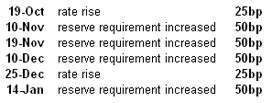

Every two weeks, on average. That’s how often China is introducing some form of tightening at the moment. The People’s Bank has just increased the reserve ratio again, by 50 basis points, or a half of one percentage point. This increases the amount of cash banks have to keep with the central bank, thus reducing the amount available to lend. Our calculations suggest rural and small-medium sized banks will have to keep 15.5 per cent of their deposits with the central bank, while larger banks will need to keep 19 per cent.

-

Tundub, et siiski viimane RRR tõstmine, mis hakkas kehtima lõppeva nädala neljapäevast, tekitas Hiina pankades korraliku likviidsusprobleemi, millest tulenevalt ka SHIBOR taevasse lendas. Miks muidu pidi Hiina keskpank reverse repot tegema, et kahte Hiina pangandusgiganti reservinõude rahuldamiseks toetada. Ühtegi paremat seletust ma ei leia. (TradingMarkets.com link):

Chinese central bank, the People's Bank of China (PBC), conducted on Thursday RMB50 billion (US$7.59 billion) reverse repos to help some lenders pay for the Thursday-effective new required reverse ratio, reported China Securities Journal citing sources on Friday.

According to the report, PBC funded two of China's five bank giants, including Industrial and Commercial Bank of China (SSE:601398, SEHK:1398), Agricultural Bank of China (SSE:601288, SEHK:1288), Bank of China (SSE:601988, SEHK:3988), China Construction Bank (SSE:601939, SEHK:0939) and Bank of Communications (SSE:601328, SEHK:3328).

In fact, the Chinese central bank has suspended all its open market operations in this week to ease up lenders' hardness in preparing cash for the RRR payment.

Publicized data shows that PBC out flowed net RMB249 billion yuan moneys into local financial sector in this week.

Previously on January 14, PBoC announced that it would lead up lenders' RRR by 0.5 per cent since Thursday, meaning a historical high 19 per cent required reserve for outsized national banks hence. -

Hiina uus aasta algab 3 veebruaril. Ma arvan, et SHIBOR spikeb osaliselt year end fix´i tõttu. See on tüüpiline, et aastalõppude ümber on mingid imelikud ja ootamatud likviidsusevajadused mis aasta vahetudes kaovad.

-

Bloomberg (6. jaanuar):

"While the seven-day repo rate has dropped 320 basis points, or 3.20 percentage points, from a three-year high of 6.34 percent in three days, it may rebound before the five-day Lunar New Year holiday that starts Feb. 2, said Zhou Yan, a fixed- income analyst in Shanghai at Bank of Communications Ltd."

“The pre-holiday cash hoarding by financial institutions and the rising inflation expectations will cause a resurgence in money-market rates. If banks extend more lending than targeted in January, the central bank may raise reserve ratios for major banks before the holidays, which will push up the repo rate even higher."

Ehk kõikide eelduste kohaselt on põhjuseks "reserve ratio" tõstmine ning aastavahetus. -

Reedel mainitud probleem ostus piisavalt suureks, et eile (esmaspäeval) otsustas PPoC taastada likviidsust – keskpank süstis süsteemi CNY300 miljardit läbi “reverse repo’de,” mis hõlbustab pankadevahelist laenamist (langetab SHIBORi). Võttes arvesse seda, et Hiina keskpanga eesmärk on majanduse “jahutamine,” kas läbi repo’de või reservmäärade tõstmise, on tegemist huvitava uudisega. Teisisõnu päris normaalseks reedel juhtunut kindlasti liigitada ei saa.